Advertisement

Advertisement

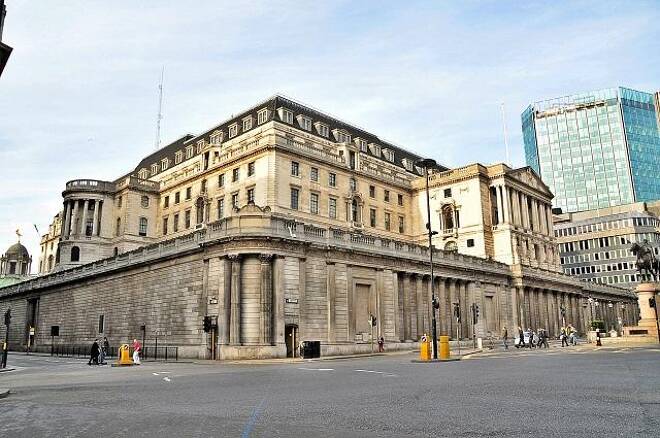

Bank of England Report Positive Stress Test Results

By:

The Bank of England (BOE) has revealed, that they believe the UK banking system would be strong enough to cope with a 2008 style severe financial crash.

The Bank of England (BOE) has revealed, that they believe the UK banking system would be strong enough to cope with a 2008 style severe financial crash.

Results from this year’s stress tests suggest that the ‘real economy’ could be supported in a downturn,. As participating banks would have the means to keep credit running, as opposed to needing billions of tax payers money to recapitalise.

The BOE’s Financial Policy Committee decided that no macro prudential actions were necessary in response to the stress tests. The stress tests focused on the banks’ balance sheets up until the end of 2014.

Five Out of Seven Banks Report Capital Adequacy

Out of the seven participating banks, five of them reported no capital inadequacies, they were Barclays, HSBC, Lloyds Banking Group, Nationwide Building Society and Santander UK.

Although the Royal Bank of Scotland (RBS) and Standard Chartered were both picked out for some insufficiencies.

RBS did not meet its individual capital guidance, due to management decisions that had been made that has effected this aspect of their business.

The Prudential Regulation Authority (PRA), another overseeing body in the stress testing process, did not recommend that the RBS should submit another capital plan.

This decision was made in light of the steps taken by RBS to strengthen its capital position, in addition to its plans for increased tier 1 capital issuance.

The tier 1 position of a bank includes the core capital adequacy of a bank, and include all disclosed reserves that the bank holds, including capital and equities.

Standard and Chartered failed to meet its tier 1 capital ratio requirement of 6%, a level that was set by the PRA.

Similarly to the RBS, the verdict was that they did not need a revised capital plan to be appraised by the regulatory bodies, due to the action that they have already taken.

Projections Released in Bank Capital Adequacy

The banks were judged on two capital metrics, like in the 2014 tests, assessments were based on common equity Tier 1 (CET1) capital ratio of 4.5% of risk-weighted assets.

A change was made for the tests this year, as an additional leverage ratio threshold has been introduced of 3%, this was set to be met with Tier 1 capital.

To reach the projections of banking adequacy, in-house models were used, alongside analysis on a sector by sector basis, and comparisons with rival banks.

As an aggregate score from all participating banks, the BOE released figures of the shortfall of the contributions of Common Equity Tier 1 (CET1) ratio, or banks core equity ratio compared to risk weighted assets.

This was from a comparative angle of the baseline projection for 2016, to the lowest point of bank stress.

It was that the stress scenario would reduce would reduce the aggregate CET1 ratio across the seven banks from the baseline figure of 12% to a low point of 7.6%.

Pound Climbs Against the US Dollar

The news from the BOE has contributed to the pound rising from the canvas of the $1.50 mark against the dollar, and has steadily climbed this morning GMT to buy $1.51.

The dollar has also been sliding down against major currencies, due to recently released weak home sales data.

In comparison to the euro, the pound has also gained in the past 24 hours, and is now buying EUR 1.42, from the relative nadir of EUR 1.41 level early yesterday afternoon GMT

About the Author

Peter Tabernerauthor

Advertisement