Advertisement

Advertisement

Dollar Rises on Federal Reserve Vice Chairman Upbeat on US Economy

By:

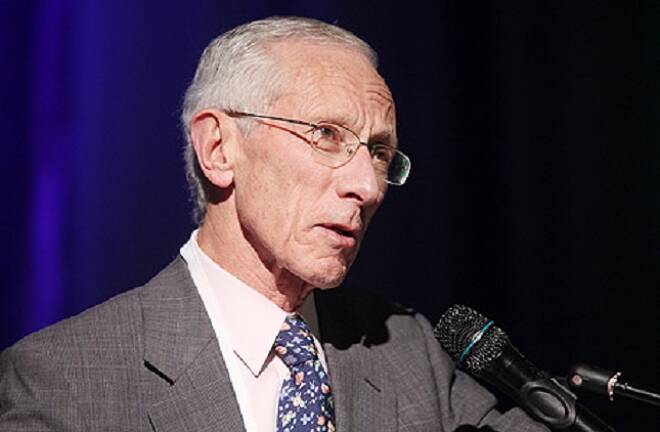

The Federal Reserve’s vice chairman Stanley Fischer has said that the United States is now heading to its target on employment and inflation, which is

The Federal Reserve’s vice chairman Stanley Fischer has said that the United States is now heading to its target on employment and inflation, which is certain to intensify the debate about whether interest rates will rise in the near future.

In speech delivered in Colorado, Fischer was enthusiastic about the prospects for the US economy, although he did not refer to interest rates specifically, on the labour market he said that the pace of growth was more than enough for the labour market to continue to make strides forward.

The US Bureau of Labor Statistics recent monthly employment figures revealed that there were 255,000 more jobs in the labour market for July, which left unemployment at 4.9%, unemployment has fallen steadily since 2011 when five years ago, the rate of those without a position reached just over 9%.

On inflation, Fischer believes that the Unites States is now within distance of the 2% target, if you disclude food and energy prices, last week the latest consumer price index showed that prices were unchanged in July, the weakest price index figures since February.

Fischer did warn that he has major concerns over current levels of productivity growth, which has the capacity to curtail job growth and reduce wages.

Monex Europe in their daily report on the foreign exchange market, said that Fischer is the latest in a line of several Federal Open Market Committee (FOMC) members, that have attempted to get markets to take the prospect of rate hikes in the near future more seriously, but the Federal Reserve’s own caution in raising rates belies the hawkish rhetoric coming from the FOMC.

Market pricing indicates investors are overwhelmingly sceptical about the prospect of the Federal Reserve carrying out the rate rise threat, meaning that if rates do increase in September the prospect for market volatility is high, as traders scramble to cover short USD and long US fixed income positions.

The forex company also argues that the Federal Reserve’s chair Janet Yellen’s speech at the Jackson Hole Symposium on Friday is expected to be an important event, and is perhaps the central bank’s best chance of communicating its intentions.

So far this morning GMT, the dollar has lost ground on the British pound, with the GBP/USD rate at $1.3089, with the greenback peaking so far at GBP/USD $1.30, there is little economic data that is due to be released in the UK, leaving market sentiment as the main driver of the pound’s fortunes.

While against the euro, the dollar has appreciated, with the EUR/USD falling from Friday’s apex of £1.34 down to this morning’s figure of just over the $1.12, the euro is expected to strengthen this week if the speculation on an interest rate hike calms down.

This week there is significant data that will be released in the United States, including new home sales data, which will be the first release of the week, due tomorrow and the forecast places the data on $575,000.

This is followed by crude oil inventories on Wednesday, as the first piece of top-tier data for the week, the figures will be eagerly anticipated, while unemployment claims data is due Thursday and forecast at 265,000, alongside core durable goods orders, which is forecast at 0.4%.

About the Author

Peter Tabernerauthor

Advertisement