Advertisement

Advertisement

Three Central Banks Stand Pat

By:

In the last 24 hours, 3 major central banks surprised investors by sitting tight. The Federal Reserve held rates and policy and did little to change its

In the last 24 hours, 3 major central banks surprised investors by sitting tight. The Federal Reserve held rates and policy and did little to change its statement. The Bank of Japan followed suit as well as the Reserve Bank of New Zealand. The US dollar fell 26 points in the morning session to trade at 94.12 while the kiwi gained 32 points after the RBNZ to trade at 0.6916. The biggest surprise was the Bank of Japan. Most traders were expecting some aggressive action to help the current weak economic situation. The Japanese yen showed a harsh reaction to the decision. The USD/JPY tumbled 215 points to 109.30 while against the euro the EUR/JPY fell 242 to 123.80.

Marketwatch reported that the Dow Jones Industrial Average and the S&P 500 index ended slightly higher Wednesday after the Federal Reserve left interest rates unchanged and provided little indication when it would deliver another rate rise. Initially, stocks had extended losses following the Fed statement only to rebound to carve out new session highs. The Dow Jones rose 51.23 points, or 0.3%, to close at 18,041.55, coming off an earlier 70-point deficit. The Nasdaq underperformed other indexes, slumping 25.14 points, or 0.5%, to finish at 4,863.14. Earlier, the Nasdaq had traded down by as many as 62 points.

Stock markets cross Asia had risen earlier on Thursday in expectation of more stimulus from the central bank, especially after figures showed that Japan’s consumer prices dropped last month by the most in three years. (The Guardian)

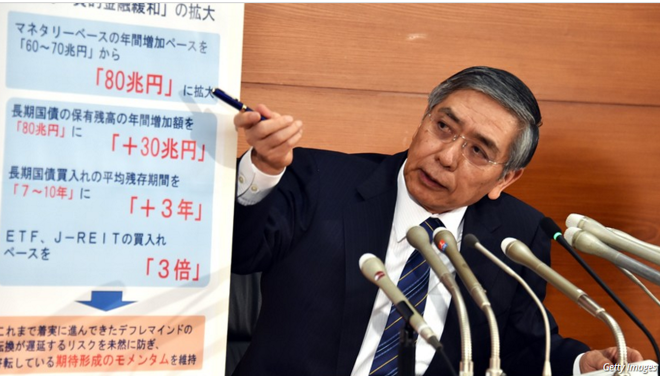

In addition to the worse-than-expected fall – 0.3% in March – separate data showed household spending remains weak, although factory output rebounded. The central bank maintained its pledge to increase base money, or cash and deposits in circulation, at an annual pace of 80 trillion yen ($730bn). It also left unchanged a 0.1% negative interest rate it applies to some of the excess reserves financial institutions park at the BOJ. The central bank has been ratcheting back its timeline for reaching a 2% inflation target, which was unveiled along with a huge asset-buying plan in early 2013.

The BoJ’s moves are a cornerstone of Abenomics, which has struggled to boost Japan’s lukewarm economy despite plenty of fanfare.

In New Zealand this morning Graham Wheeler held rates and policy. The Reserve Bank of New Zealand has left interest rates unchanged at the conclusion of its April monetary policy meeting. The decision, correctly predicted by 13 of 16 economists polled by Bloomberg, left the cash rate at a record-low level of 2.25%.

Business Insider said that While the bank refrained from reducing interest rates at this meeting, the tone of the accompanying monetary policy statement suggests that further interest rate reductions may still arrive in the months ahead. Reinforcing this view, the bank retained its easing bias, indicating that further monetary policy easing may be required to support economic growth and inflation expectations.

“Further policy easing may be required to ensure that future average inflation settles near the middle of the target range,” said the RBNZ. “We will continue to watch closely the emerging flow of economic data.”

The also bank suggested that there were “many uncertainties” around the outlook for the New Zealand economy.

“Internationally, these relate to the prospects for global growth, particularly around China, and the outlook for global financial markets,” the statement read. “The main domestic risks relate to weakness in the dairy sector, the decline in inflation expectations, the possibility of continued high net immigration, and pressures in the housing market.”

The bank also expressed concern towards recent strength in the New Zealand dollar — continuing the theme seen in prior statements — noting that it “remains higher than appropriate given New Zealand’s low commodity export prices”, adding that “a lower New Zealand dollar is desirable to boost tradable inflation and assist the tradable sector”. (BI)

About the Author

Barry Normanauthor

Advertisement