Advertisement

Advertisement

EUR/GBP, EUR/JPY & GBP/JPY: Technical Checks

By:

EUR/GBP Following its gradual recovery from 61.8% FE of November 2015 – April 2016 upside, the EURGBP again confronts the 0.8620-30 resistance-zone,

EUR/GBP

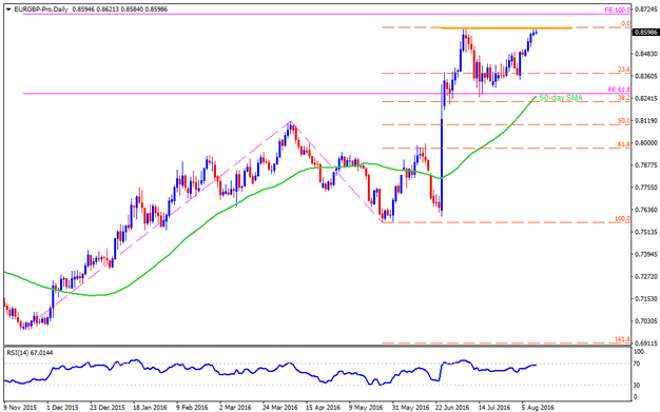

Following its gradual recovery from 61.8% FE of November 2015 – April 2016 upside, the EURGBP again confronts the 0.8620-30 resistance-zone, comprising July 2016 high. However, pair’s inability to break the same area on Thursday, coupled with overbought RSI level, indicates brighter chances of its consecutive pullback towards 0.8500, 0.8425 and the 23.6% Fibonacci Retracement of its May – July rally, around 0.8375. Given the pair drops below 0.8375, the previously mentioned 61.8% FE and 50-day SMA region of 0.8250-60 becomes crucial to observe, which if broken makes the pair vulnerable to test 0.8100 round figure mark. On the upside, a clear break above 0.8630 can quickly fuel the pair to 100% FE level of 0.8700 while its additional run-up beyond 0.8700 enables it to aim for 2013 highs of 0.8815. If the pair continue extending its northward journey above 0.8815, the 0.8890 and the 2011 highs of 0.9085 are likely upside figure to witness on the chart.

EUR/JPY

Even if the EURJPY trades at the highest level in more than a week, a month-old downward slanting trend-channel resistance, around 114.30, immediately followed by 38.2% Fibonacci Retracement of June month crash, at 114.45, could confine the pair’s upside attempts. If the pair successfully runs above 114.45, also clears the 114.80 intermediate halt, it can rally towards 115.80 and the 116.20 resistances. Alternatively, 113.30 and 112.80 are nearby supports to watch, breaking which 23.6% Fibo level of 112.50 and the 111.80 might entertain short-term bears before the pair confronts the channel support of 110.80. Should the pair fails to respect the channel support, at 110.80, chances of its revisit to Brexit-day lows of 109.30 can’t be denied.

GBP/JPY

Ever since the GBPJPY reversed from 142.40, a short-term descending trend-channel keep restricting its upside. The pair now indicates a quick test to 131.30 and the 131.00 supports before testing the 130.50 downside number. However, its further declines below 130.50 can be restricted by the 129.55-65 support-confluence, encompassing channel lower-line and a horizontal-line, failing to which can drag the pair to below July lows of 128.60. Meanwhile, 132.50-60 area is acting as immediate resistance, clearing which 133.20 and the channel resistance of 134.15 could control the pair bulls. Should the pair surpasses 134.15, it can advance to 135.50 and the 136.60-65 upside levels.

Cheers And Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement