Advertisement

Advertisement

Argentina bonds plunge, black market peso bounces as economy chief seeks calm

By:

BUENOS AIRES (Reuters) - Argentina's closely watched black market peso weakened 2.62% to 267 per dollar on Tuesday, traders said, a slower fall after it crashed on Monday amid political uncertainties sparked by the shock resignation of the country's economy minister.

By Jorge Otaola

BUENOS AIRES (Reuters) – Argentina’s closely watched black market peso rebounded on Tuesday from record lows as the country’s new economy minister moved to calm markets, though sovereign bonds plunged amid wider fears about economic crisis and default.

New economy chief Silvina Batakis was sworn in late on Monday pledging fiscal responsibility after the abrupt exit of her predecessor, Martin Guzman, sparked concerns of a shift towards populist policies and state spending.

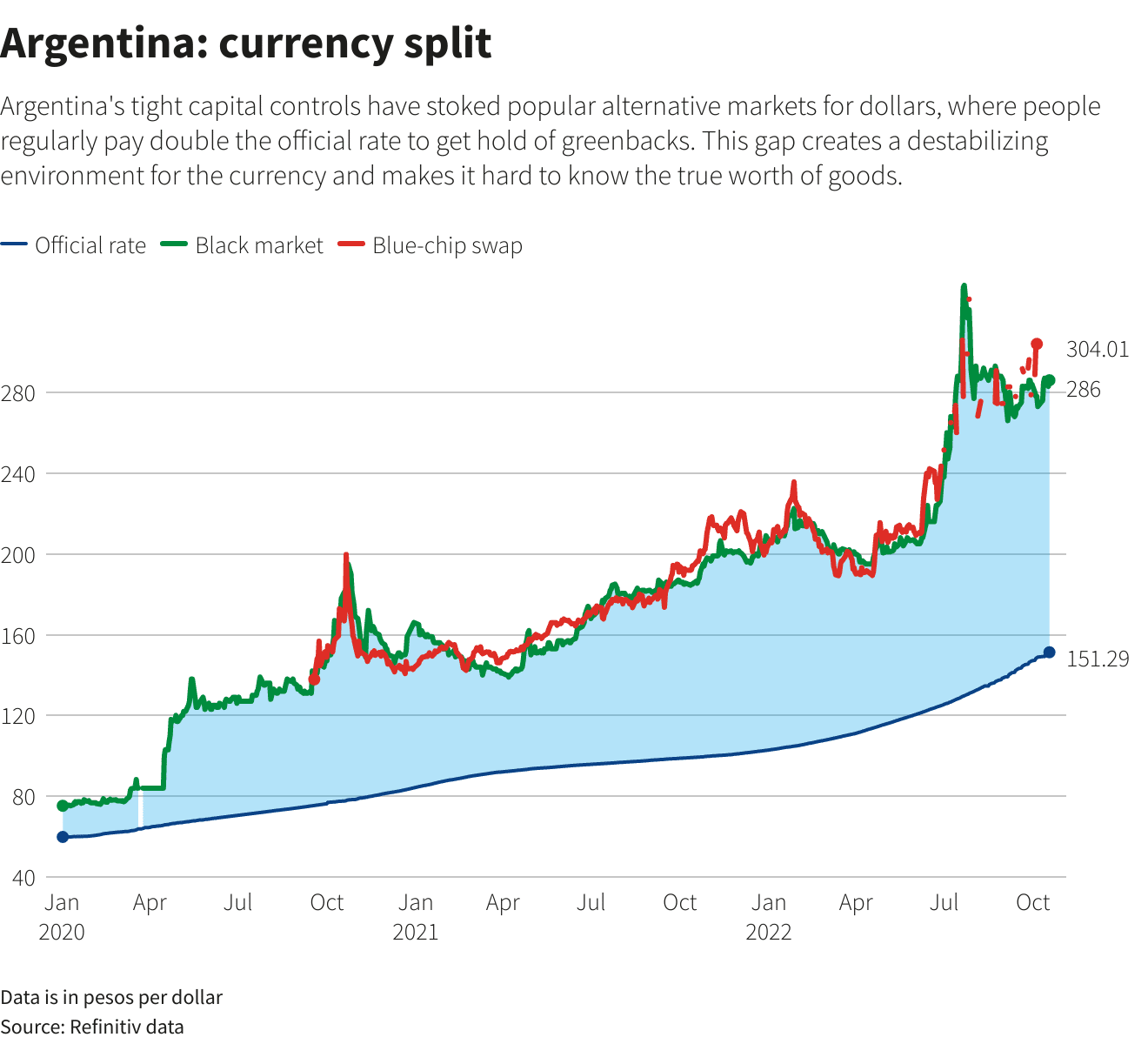

The black market peso rose 3% to 252 per dollar after an 8% crash on Monday. It is a guage of true investor sentiment in the currency with the official rate held stable by capital controls that push people into parallel markets to buy dollars.

The S&P Merval stock index rose a bit over 2% in trading on Tuesday after falling on Monday.

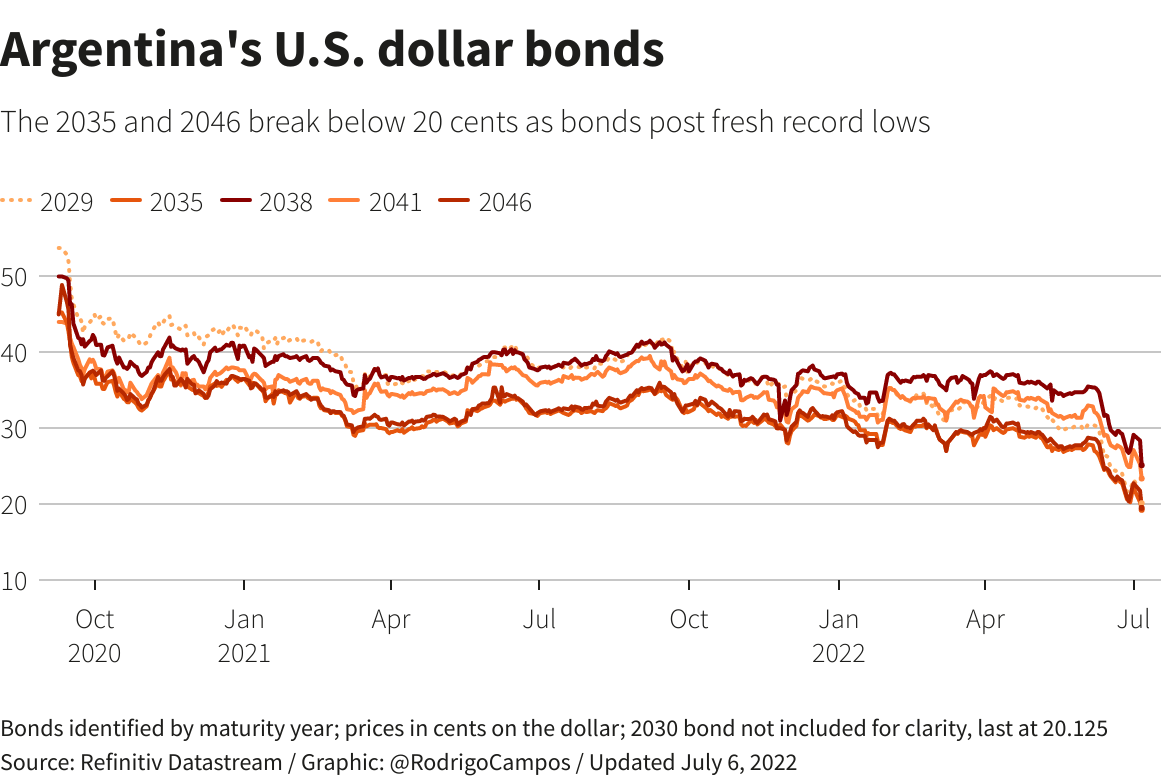

However, over-the-counter sovereign bonds, already in distressed territory of around 20-25 cents on the dollar, slipped on average 3%. A 2030 bond was down nearly 11% and a 2035 bond some 8.5%. An Argentina risk index climbed steeply.

Traders said the central bank had intervened heavily to support the peso currency and bonds. The official exchange rate, kept on a tight leash since 2019, edged down 0.18% to 126 per dollar.

“The market is red hot, with a central bank selling dollars and intervening in bonds, in pesos to try to maintain their prices,” said economist Rodrigo Alvarez.

(Reporting by Jorge Otaola; Additional reporting by Rodrigo Campos; Writing by Adam Jourdan; Editing by Bill Berkrot and Alistair Bell)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement