Advertisement

Advertisement

Commerzbank forecasts 2021 profit as European banks post strong Q3

By:

FRANKFURT (Reuters) - Germany's Commerzbank on Thursday said that it swung to a better-than-expected third-quarter net profit and would achieve a profit for the full year.

By Tom Sims and Frank Siebelt

FRANKFURT (Reuters) – In the midst of a major overhaul, Germany’s Commerzbank on Thursday posted better-than-expected third-quarter net earnings and forecast a profit for the full year, defying analysts’ predictions for a 2021 loss.

The quarterly results were supported by a decrease in provisions set aside to cushion the fallout from the pandemic, as well as lower costs.

The positive tone in Germany echoed across much of Europe’s banking sector, which for the past few years has been struggling with negative interest rates and the impact of COVID-19.

Societe Generale and ING also both reported better-than-expected profit on Thursday, helped by the release of provisions set aside for loan losses that didn’t materialise.

Shares in Commerzbank rose 6.4% in early trade, while SocGen gained 3.6% and ING 2.3%.

The outlook at Germany’s No. 2 bank is a victory for the new Chief Executive Manfred Knof, who joined the bank at the start of the year to carry out a 2 billion euro restructuring involving hundreds of branch closures and 10,000 job cuts to get back on a path to profit.

“Despite the restructuring expenses, we are anticipating a positive net result for the full year,” Knof said.

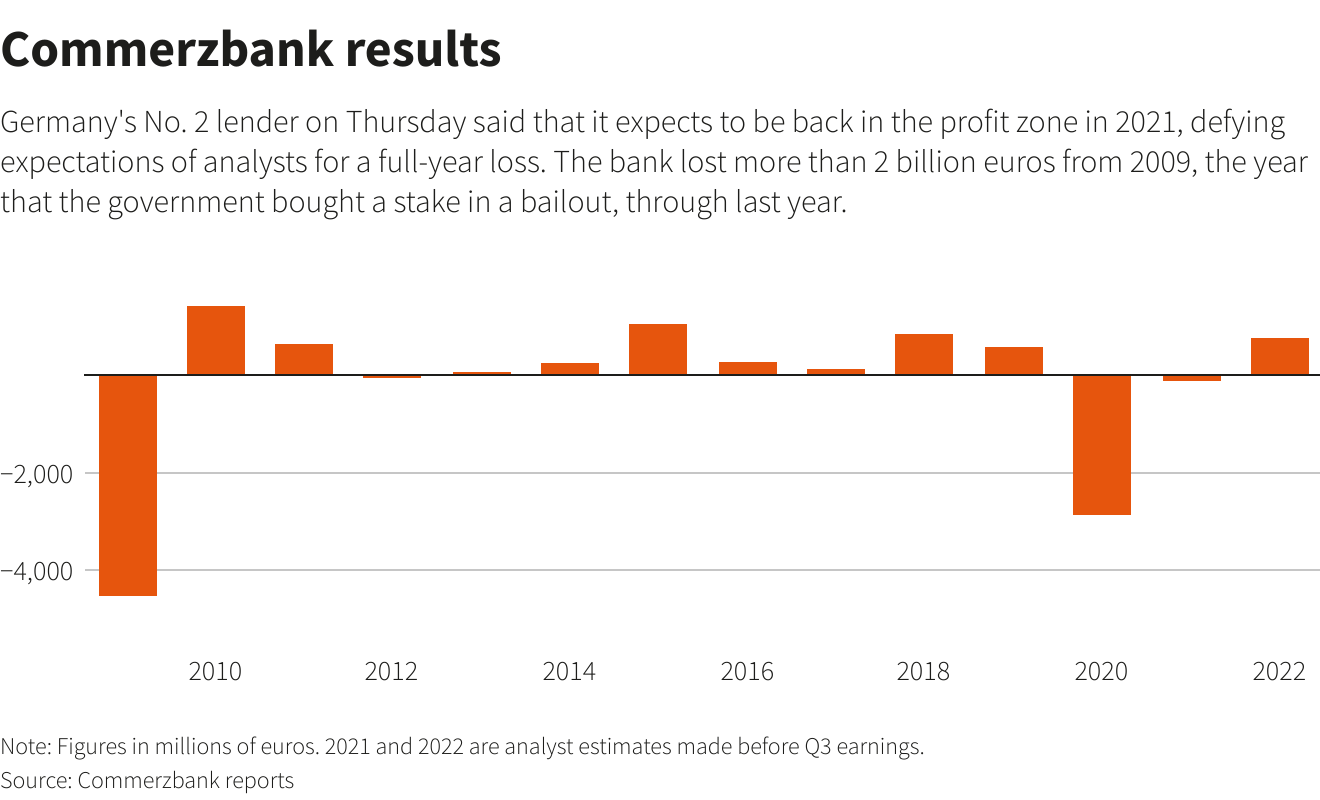

Before Thursday, analysts had expected Commerzbank to post a loss of more than 100 million euros for 2021 and to only return to profit next year. The bank posted a steep loss of 2.9 billion euros in 2020 due to restructuring costs.

It has been a rocky few years for Commerzbank. Merger talks with Deutsche Bank failed and it was ejected from the premier DAX index of German blue-chips. Last year, a major investor, Cerberus, launched a campaign for change that prompted a shuffle in top leadership and the plans for steep job cuts.

Commerzbank, which is still partially owned by the state after a bailout during the financial crisis more than a decade ago, has lost about 2 billion euros from 2009 through last year.

The bank said it was halfway through the task of cutting positions, but as it does that it is also facing demands for higher wages amid soaring inflation.

Workers will strike next week for one day as unions demand 4.5% pay increases for bankers in the industry.

Despite a decline in provisions in the quarter to 22 million euros from 272 million euros a year ago, Commerzbank’s Chief Financial Officer Bettina Orlopp told analysts that the bank wasn’t out of the woods yet.

The end of government pandemic support efforts will result in a rise in corporate defaults in the next quarter, she said.

Provisions at SocGen were around half of what analysts had expected, Jefferies said in a note.

($1 = 0.8633 euros)

(Reporting by Tom Sims and Frank Siebelt; Additional reporting by Rachel Armstrong, Matthieu Protard and Toby Sterlin; Editing by Maria Sheahan, Shounak Dasgupta, Gerry Doyle and Jan Harvey)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement