Advertisement

Advertisement

Deutsche Bank’s Profit Tops Estimates Despite Dip in Trading Revenue

By:

FRANKFURT (Reuters) - Deutsche Bank delivered on Wednesday a better-than-expected quarterly profit despite some unexpected costs and a decline in its investment banking revenue, sending shares of Germany's biggest lender up 2.2% in pre-market trading.

In this article:

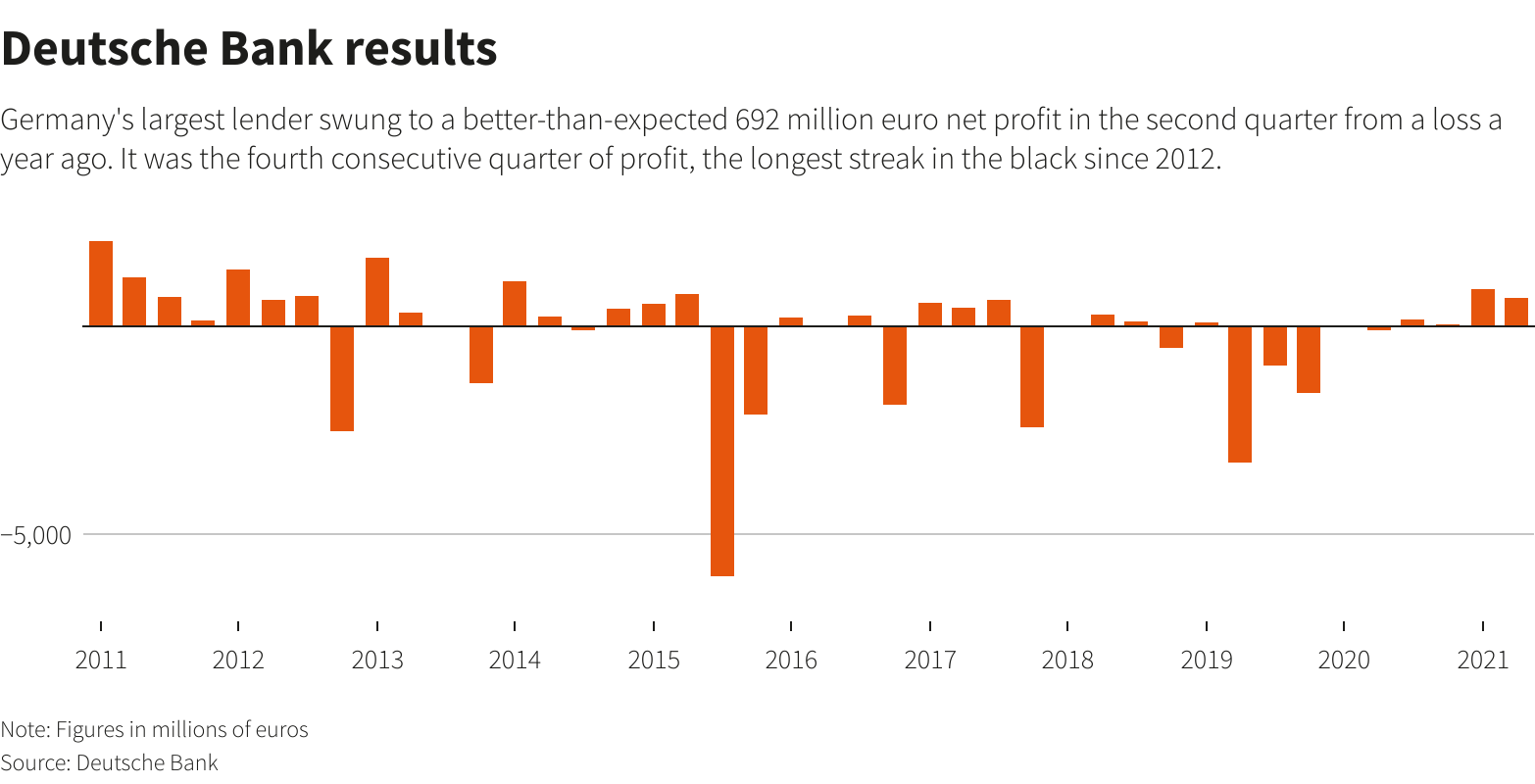

The bank posted a fourth consecutive quarterly profit, its longest streak in the black since 2012.

Net profit attributable to shareholders in the second quarter came in at 692 million euros ($818 million), from a loss of 77 million euros a year earlier. The figures were better than analyst expectations for a profit of 372 million euros.

Deutsche Bank‘s results were supported by a decrease in provisions set aside to cushion fallout from the coronavirus pandemic. Provisions for credit losses were 75 million euros, down from 761 million euros a year earlier.

A pocket of strength was the investment bank’s advisory business amid a boom in dealmaking, with revenue surging 166% to 111 million euros. An increase in asset management revenue and fees also helped boost the bottom line.

The profit figures are good news for Chief Executive Officer Christian Sewing, who launched a major restructuring in 2019 that involved shedding 18,000 staff in the hopes of returning the bank to profitability.

“Our priority now is to continue with our disciplined execution of transformation, quarter by quarter,” Sewing said in a statement.

The company decided to abandon a key target – an aim of reducing costs to 16.7 billion euros by 2022. The move came in after Deutsche Bank flagged a number of unexpected costs in recent months.

Sewing said he was committed to a 70% cost-income ratio target, as the lender will now focus on cost-to-income ratio.

Much has been riding on the performance of Deutsche’s investment bank, the group’s biggest revenue generator that helped the bank eke out a small profit for 2020, its first after five years of losses. Gains in the investment banking unit drove the bank to its strongest quarter in seven years at the start of 2021.

Revenue at the unit declined 11% in the second quarter from a year earlier. It was the biggest fall in investment banking revenue since the bank’s revamp two years ago, but U.S. rivals also saw a decline in the quarter.

Investors have wondered how sustainable progress will be as the bank continues to make efforts to boost profitability after years of losses.

The unit lost market share across an array of key services in the second quarter, data from Dealogic shows, demonstrating the fragility of recovery for the German lender.

($1 = 0.8460 euros)

(Reporting by Tom Sims and Patricia Uhlig; Editing by Kirsti Knolle, Maria Sheahan and Sherry Jacob-Phillips)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement