Advertisement

Advertisement

Dollar resumes slide as stock markets tentatively pick up

By:

By Tom Westbrook SINGAPORE (Reuters) - The dollar nursed last week's losses on Monday and was headed for its first monthly drop in five months as investors have scaled back bets that rising U.S. rates will spur further gains and as fears of a global recession have receded a little.

By Iain Withers

LONDON (Reuters) – The U.S. dollar resumed its slide on Monday as risk appetite across markets tentatively strengthened, supported by encouraging economic data and bets that the Federal Reserve will tighten policy at a slower pace.

The dollar index – which tracks the greenback against six major rivals – is on track for its first monthly drop in five, as the safe-haven currency loses steam after a breakneck start to the year.

The dollar index is on track for a more-than 1.5% drop in May – although it remains up about 6% on the year. It was last down 0.3% on the day at 101.440.

Trade was likely to be light through Monday as U.S. stock and bond markets close for the Memorial Day public holiday.

(Graphic: Dollar – https://fingfx.thomsonreuters.com/gfx/mkt/myvmnwqyzpr/Pasted%20image%201653911109754.png)

Data on Friday showed that U.S. consumer spending rose more than expected in April as households boosted purchases of goods and services, and the rise in inflation slowed.

Analysts said the encouraging data, coupled with bets on a more cautious tightening path by the Fed, was weakening the dollar.

World share markets rose on Monday as easing COVID-19 restrictions and new stimulus in China helped sustain last week’s rebound.

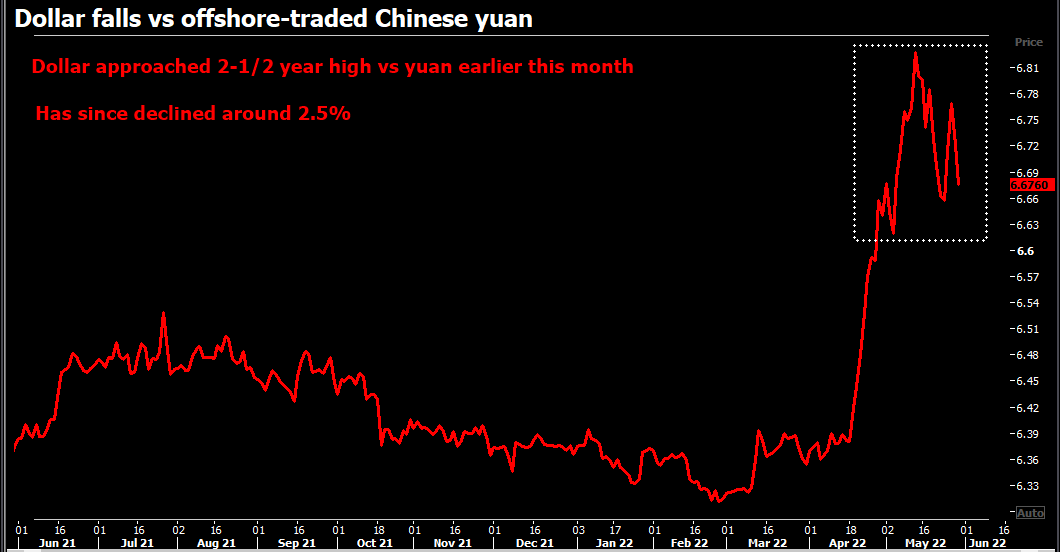

The offshore-traded Chinese yuan strengthened as much as 1% versus the dollar on the reopening news, and was last up 0.7% at 6.6771 yuan per dollar.

“How the US consumer plays out from here and from a global perspective how the Chinese economy performs will be crucial determinants for broader investor risk appetite,” currency analysts at MUFG said in a note.

A slew of further economic data is due this week which could give clues on the outlook for global growth, including U.S. jobs numbers and Chinese Purchasing Managers’ Index figures.

Inflation data from Germany and Spain on Monday showed price rises accelerated in May, pushed up by soaring energy prices, ahead of euro zone inflation figures on Tuesday.

The inflation numbers helped keep a lid on the euro’s gains, with the single currency last up 0.3% at $1.07700, after earlier hitting a monthly high of $1.07810.

The safe haven yen fell back 0.5% to 127.715 yen per dollar.

Sterling edged up 0.1% to $1.26405.

Cryptocurrencies attempted a bounce but bitcoin, which rose 4%, is still pinned around $30,000.

(Reporting by Iain Withers, Additional reporting by Sujata Rao in London and Tom Westbrook in Singapore, Editing by Catherine Evans and Alistair Bell)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement