Advertisement

Advertisement

Exxon Scrambles to Stave Off Dissidents as Board Fight Nears Climax

By:

(Reuters) - Exxon's business strategy hung in the balance on Wednesday as it scrambled to stave off a challenge from investors aiming to reshape its board and align the largest international oil major's growth plans with global moves to combat climate change.

By Jennifer Hiller and Svea Herbst-Bayliss

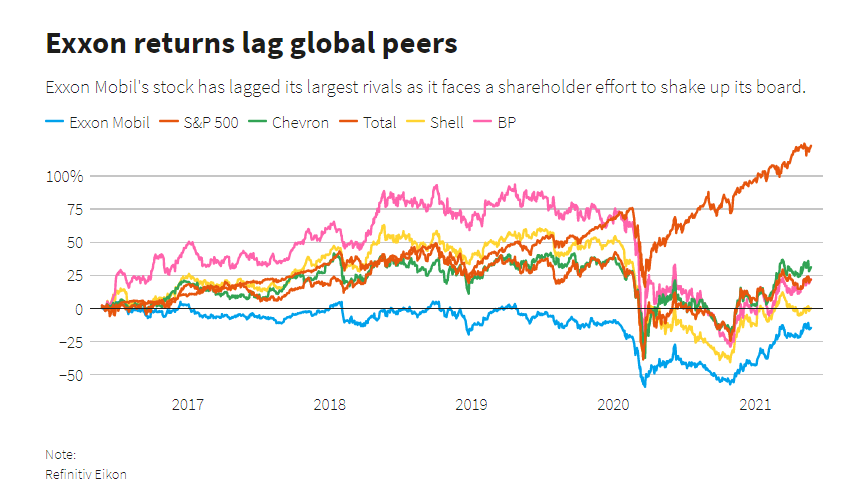

Exxon Mobil Corp has lagged other oil majors in its response to climate change concerns, forecasting many more years of oil and gas demand growth and doubling down on investments to boost its output – in contrast to global rivals that have scaled back fossil fuel investments.

A dissident shareholder group led by tiny fund Engine No. 1 is seeking to replace as many as a third of the 12-member board of directors at Wednesday’s shareholder meeting, the first major boardroom contest at an oil major that makes climate change the central issue.

Shareholders, led by Engine No. 1, have said the world is changing quickly as governments and companies move to reduce the emissions from fossil fuels that are warming the planet, and that Exxon Chief Executive Darren Woods needs to make big changes to ensure the company’s future value to investors.

Engine No. 1, which has put up a slate of four nominees, has successfully rallied support from institutional investors and shareholder advisory firms upset with Irving, Texas-based Exxon for its weak financial performance in recent years. It has just a $50 million stake in Exxon, which carries a market value of nearly $250 billion.

“The world around them is changing,” said Aeisha Mastagni, a portfolio manager at California State Teachers’ Retirement System, which backed the activists.

The proxy fight has taken on “monumental” importance, Mastagni said.

BlackRock Inc, Exxon’s second-largest shareholder, joined the dissidents, as it will support three of Engine No. 1’s nominees, Reuters reported on Tuesday.

In a Wednesday news release, Engine No. 1 cautioned shareholders that Exxon may contact them to attempt to sway them into voting for the company’s nominees, a signal that each side is still trying to woo investors to their side.

“Engine No. 1 urges shareholders not to fall prey to any such strategic efforts that may result in unintended consequences with respect to the overall result,” the hedge fund said in its release.

Exxon has fought to keep climate activists at bay, spending tens of millions of dollars on a high-profile PR campaign, agreeing to publish more details of its emissions and coming out in support of carbon reduction. Activists have said it is too little, too late, and that Exxon needs a less reactive strategy.

“This proxy fight reflects this broad change in how our political leaders, our business leaders and our fellow shareholders are stepping up and taking these immense risks seriously,” New York State Comptroller Thomas DiNapoli said.

The state’s pension fund in April said it backed Engine No. 1’s slate.

“My bet is activists win a couple of seats and it is short-term negative ExxonMobil,” independent oil analyst Paul Sankey said in a Wednesday note.

On Monday, Exxon said it would add two new directors to its board, one with climate industry experience, in an attempt to win enough institutional support.

Exxon added three new directors to its board earlier in the year as the pressure from Engine No. 1 and hedge fund D.E. Shaw, which voiced similar complaints, mounted. D.E. Shaw kept its dealings with Exxon largely out of the limelight.

“We have one of the strongest boards in corporate America,” Woods said in an interview last week.

Exxon’s board understands the company’s complexity and supports a path toward carbon reductions in the Paris accord, Woods said, referring to the international agreement aimed at combating climate change.

Exxon shares were down 0.2% in Wednesday morning trading. The stock has lagged its peers over the last five years.

Difficult challenge

The viability of Exxon’s climate strategy and past resistance to shareholder concerns lay behind BlackRock’s vote, people familiar with the decision said.

Exxon can expect strong support from retirees and smaller investors that count on the company’s rich dividend. Proxy fights are notoriously difficult for challengers, said a hedge fund executive not involved in Exxon.

Preliminary vote results are expected by midday. Results will show if there is broad support among energy investors for a transition to cleaner fuels necessary to limit worldwide temperature increases. There will be no need for new oil and gas projects if investors want net-zero carbon emissions by 2050, the International Energy Agency said this month.

Wednesday’s vote “is a good example of activist stewardship to help the company get the board it needs for the energy transition,” said Robert Eccles, a professor at Saïd Business School at the University of Oxford.

(Reporting by Jennifer Hiller in Houston and Svea Herbst-Bayliss in Boston; editing by Gary McWilliams, Will Dunham, Michael Perry and Emelia Sithole-Matarise)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement