Advertisement

Advertisement

Global equity funds see massive outflows on slowdown fears

By:

(Reuters) - Global equity funds witnessed a surge in outflows in the week ended May 11, as fears of an economic slowdown and further tightening by major central banks to tame stubborn inflation spooked investors.

(Reuters) – Global equity funds witnessed a surge in outflows in the week ended May 11, as fears of an economic slowdown and further tightening by major central banks to tame stubborn inflation spooked investors.

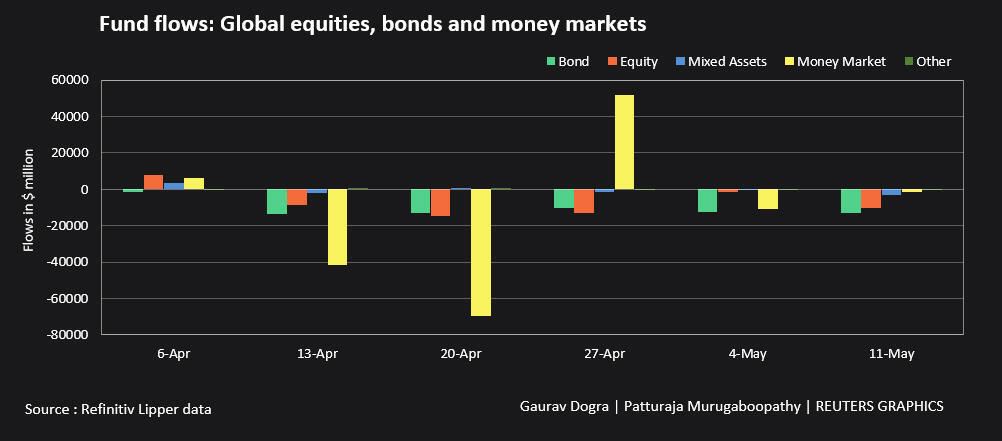

In a fifth straight week of net selling, investors liquidated global equity funds worth $10.53 billion, compared with just $1.65 billion worth of net selling in the previous week, according to Refinitiv Lipper.

MSCI’s index of world shares plunged to a 1-1/2-year low of 607.4 this week as inflationary pressures raised fears of an economic hard landing.

U.S. equity funds witnessed net selling worth $8.46 billion, European funds saw disposal of $4.33 billion, but investors were net buyers in Asian funds worth $2.23 billion.

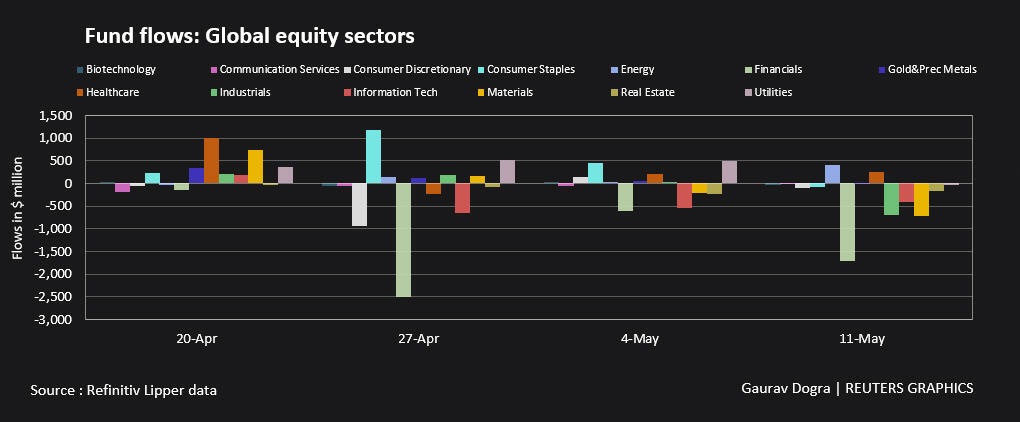

Among sector funds, financials record a sixth subsequent week of outflows, amounting $1.71 billion. Investors also drew about $0.7 billion each out of mining and industrials.

Meanwhile, global bond funds posted outflows of $13.23 billion in a sixth straight week of net selling.

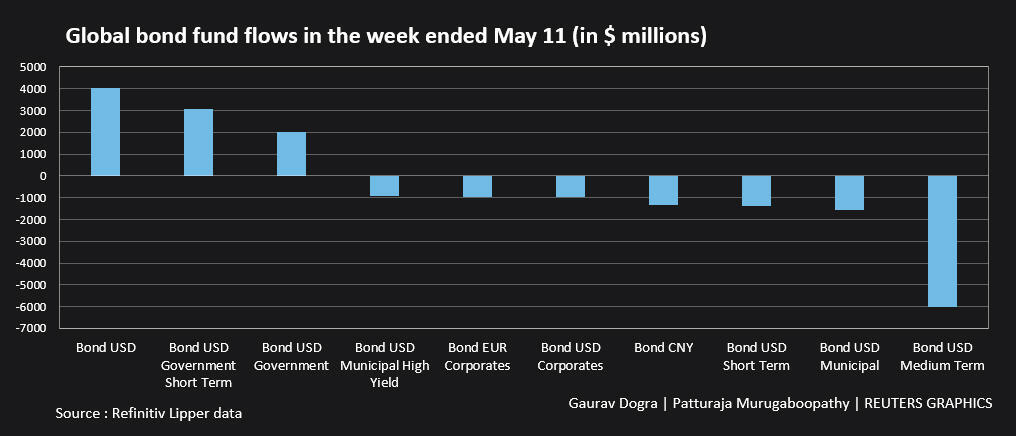

Global short- and medium-term bond funds saw outflows of $8.14 billion in the biggest weekly outflow since at least June 2020, but government bond funds lured a third weekly inflow, worth a net $3.38 billion.

Investors also withdrew $1.73 billion out of money market funds in their second weekly net selling in a row.

Data for commodities’ funds showed that weekly net selling in gold and precious metal funds jumped to a two-month’s peak of $1.54 billion, as gold prices broke below their 200-day moving averages.

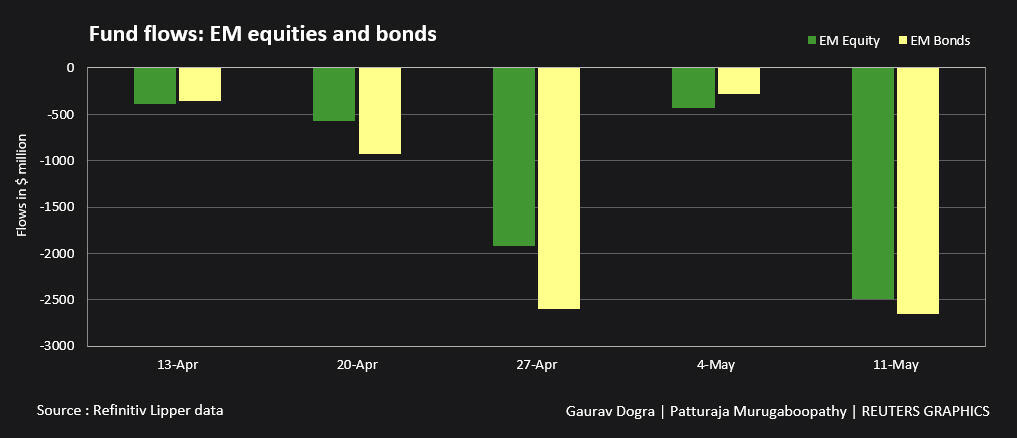

An analysis of 24,155 emerging market funds showed that investors sold equity funds of $2.49 billion and bond funds of $2.65 billion, marking a fifth consecutive week of outflow in both segments.

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Sherry Jacob-Phillips)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement