Advertisement

Advertisement

India imposes windfall tax on oil producers, fuel exporters

By:

By Nidhi Verma, Manoj Kumar and Sudarshan Varadhan

By Nidhi Verma, Sudarshan Varadhan and Manoj Kumar

NEW DELHI (Reuters) – India has imposed windfall tax on oil producers and refiners who have boosted product exports to gain from higher overseas margins as the government seeks to increase local supply of fuels to meet rising demand and increase federal revenues.

New taxes along with export restrictions will curb fuel exports by refiners Reliance Industries and Nayara Energy, part-owned by Russia’s Rosneft, and could further tighten global oil product supplies and support prices.

Their shares, along with those of oil producers Oil and Natural Gas Corp, Oil India Ltd and Vedanta Ltd tumbled as the taxes will dent their earnings.

Private refiners Reliance and Nayara have been among India’s biggest buyers this year of discounted Russian supplies and have been reaping major profits by reducing domestic sales and aggressively boosting fuel exports, including to buyers in Europe, where many buyers are avoiding imports of Russian crude.

In contrast, state refiners have cranked up runs to meet rising local demand and sell fuels at the government-capped lower prices. Some state refiners have also issued tenders to import fuels.

Reliance shares fell as much as 8.9% to 2,365 rupees apiece, their biggest intra-day percentage drop since November 2020, while Mangalore Refinery and Petrochemicals slumped 10% to 81.55 rupees.

Those of state rivals Indian Oil Corp, Hindustan Petroleum and Bharat Petroleum rose after the announcement of the export restrictions and taxes of 6 rupees per litre for both gasoline and jet fuel and 13 rupees per litre for gasoil.

“While crude prices have increased sharply in recent months, the prices of diesel and petrol have shown a sharper increase. The refiners export these products at globally prevailing prices, which are very high,” the government said in a statement.

“As exports are becoming highly remunerative, it has been seen that certain refiners are drying out their pumps in the domestic market.”

New restrictions require oil companies exporting gasoline to sell to the domestic market the equivalent of 50% of the amount sold overseas for the fiscal year ending on March 31, 2023.

For diesel, they are required to sell domestic buyers the equivalent of at least 30% of the amount that they export.

Vedanta shares dropped as much as 7.6% to hit their lowest since March 2021 and those of ONGC fell 14.2%, their worst intra-day percentage fall since March 2020.

New export restrictions will not apply to export-focussed units like Reliance’s 704,000 bpd refinery at Jamnagar in western Gujarat and on supplies to Bhutan and Nepal, the government orders said.

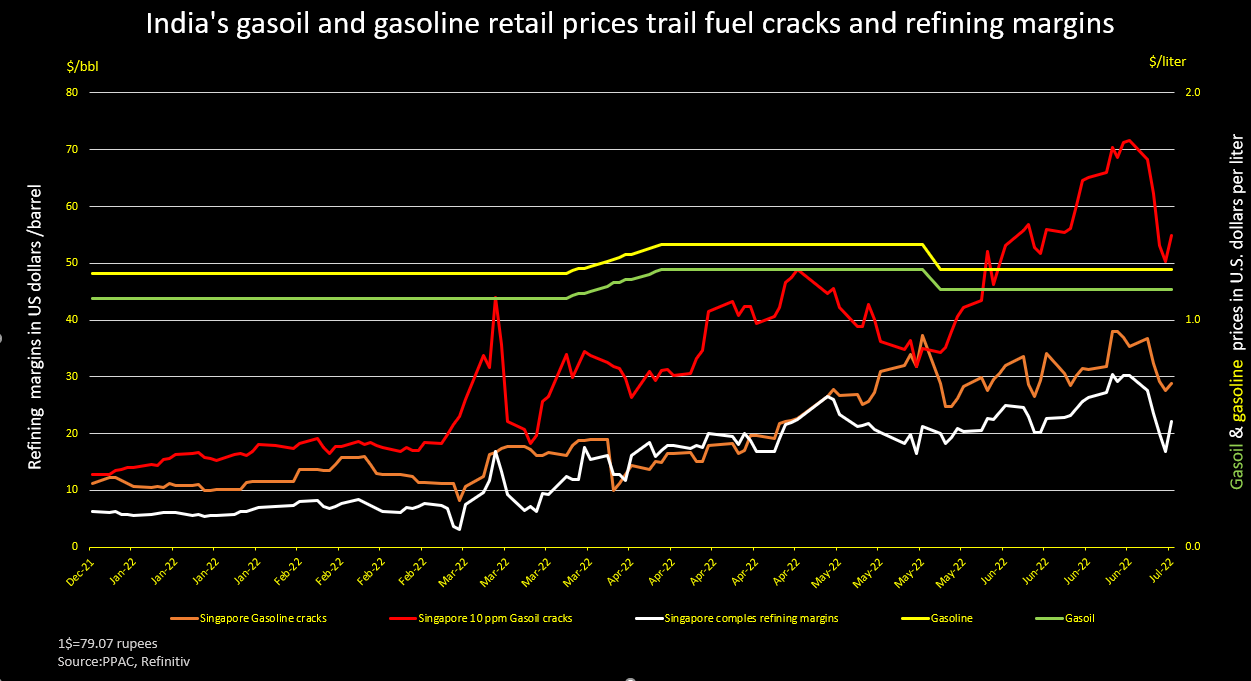

Refining profit margins, or cracks, for the 10 ppm gasoil grade jumped to $54.93 per barrel over Dubai crude on Friday, Refinitiv Eikon data showed. Margins for jet fuel rose $6.72 to $47.22 per barrel over Dubai crude, while gasoline cracks in the region rose to $28.75 a barrel.

“Crude prices have risen sharply in recent months. As a result, the domestic crude producers are making windfall gains,” the government statement said, justifying imposition of a levy of 23,250 Indian rupees ($294.04) per tonne on local crude sales.

The new windfall tax will not apply on incremental barrels produced by the companies this fiscal year and to small explorers that produce less than 2 million barrels in the last fiscal year to March 31, 2022.

($1 = 79.0700 Indian rupees)

(Additional Reporting by Aftab Ahmad, Sethuraman N. R and Mohi Narayan; editing by Robert Birsel and Emelia Sithole-Matarise)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement