Advertisement

Advertisement

Marketmind: Detente and dollars

By:

A look at the day ahead in U.S. and global markets from Mike Dolan.

A look at the day ahead in U.S. and global markets from Mike Dolan.

As investors closely monitor shifting economic sands, signs of some easing of this year’s tense geopolitics adds a tailwind to the yearend market bounce.

The dollar’s ongoing retreat, amid hopes of a downshift in U.S. interest rate rises next month that Federal Reserve Vice Chair Lael Brainard encouraged late Monday, also riffs off a defusing of at least some extreme political risks.

World leaders meeting at the G20 summit in Indonesia worked on a final communique to represent consensus on Russia’s invasion of Ukraine – but detente of sorts between the world two biggest economies on Monday was just as significant.

U.S. President Biden and China’s leader Xi Jinping talked for hours, indicated a desire to avoid another cold war between the two powers and condemning Russia’s nuclear threats in Ukraine.

Ukraine’s President Volodymyr Zelenskiy calling on G20 to stop Russia’s war in his country – a day after CIA Director William Burns met in Turkey with Russian foreign intelligence chief Sergei Naryshkin to convey the consequences of any use of nuclear weapons.

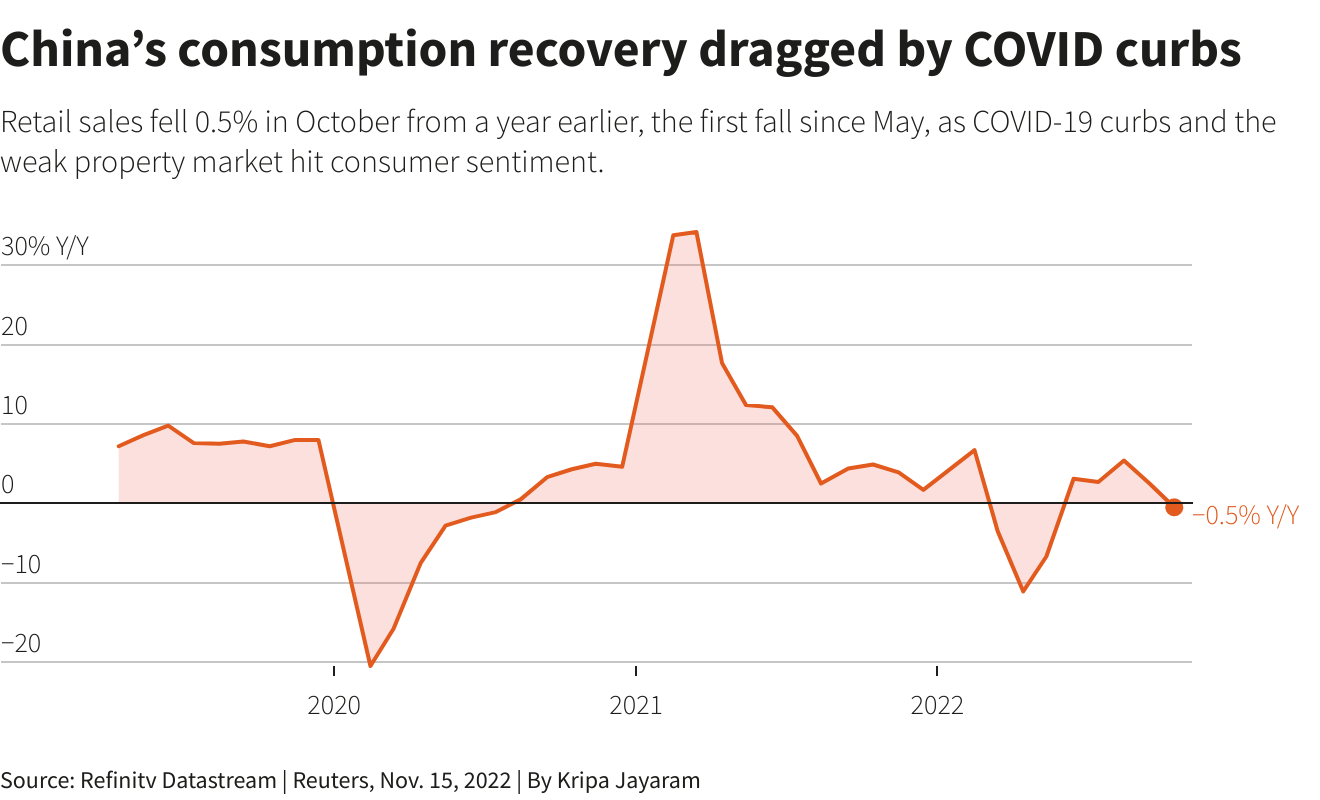

With eyes on the implications for economic and regulatory rows between Washington and Beijing, China stocks and the yuan climbed sharply again on Tuesday – even in the face of another dour set of industrial and retail data and some unrest in city of Guangzhou over rising COVID infections and related curbs.

JPMorgan cut its full-year 2022 China growth forecast to 2.9% from 3.1% previously and its 2023 forecast to 4% from 4.5%.

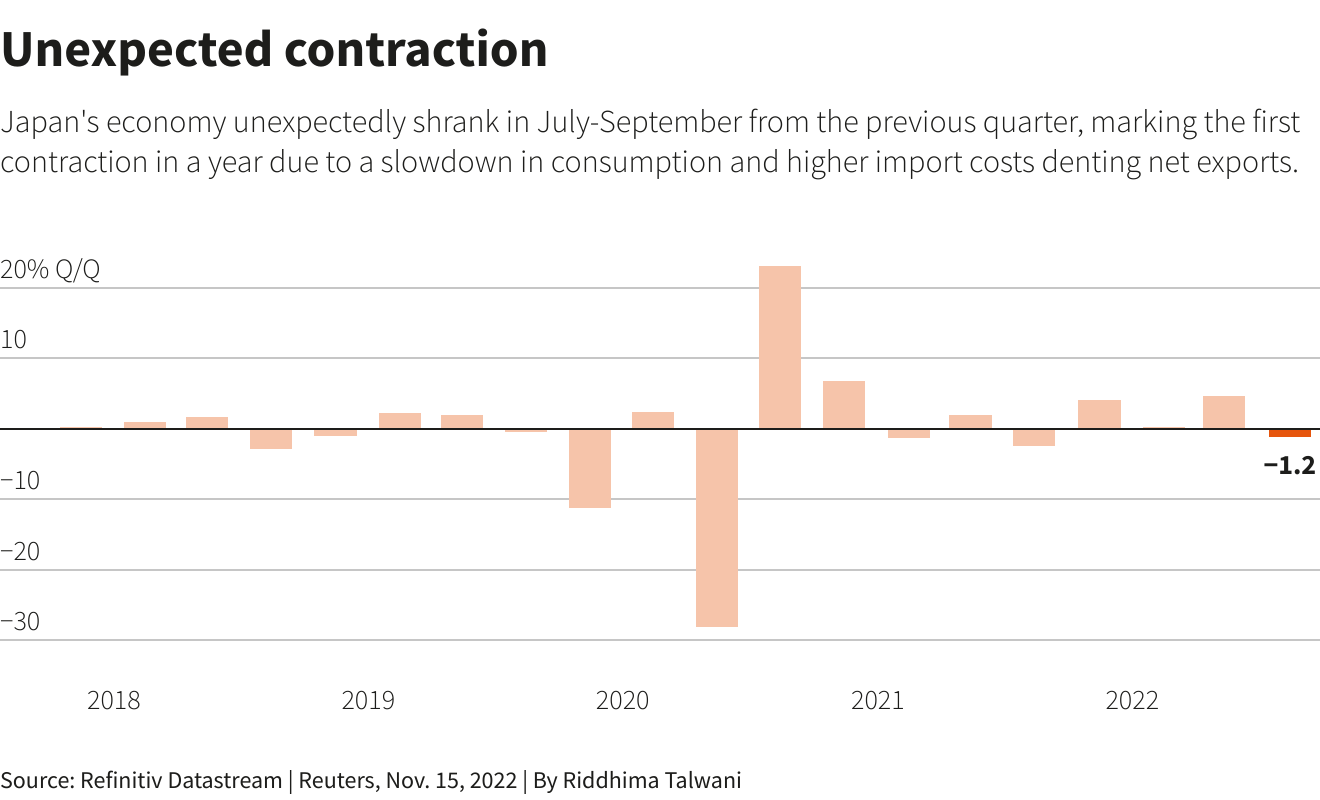

The economic picture in Japan was no better as economy there unexpectedly shrank 0.3% in the third quarter

But aiding the rise of euro/dollar to its highest in four months, the picture in Europe was better as German investor sentiment rose again in November and ECB officials continued to talk of higher interest rates.

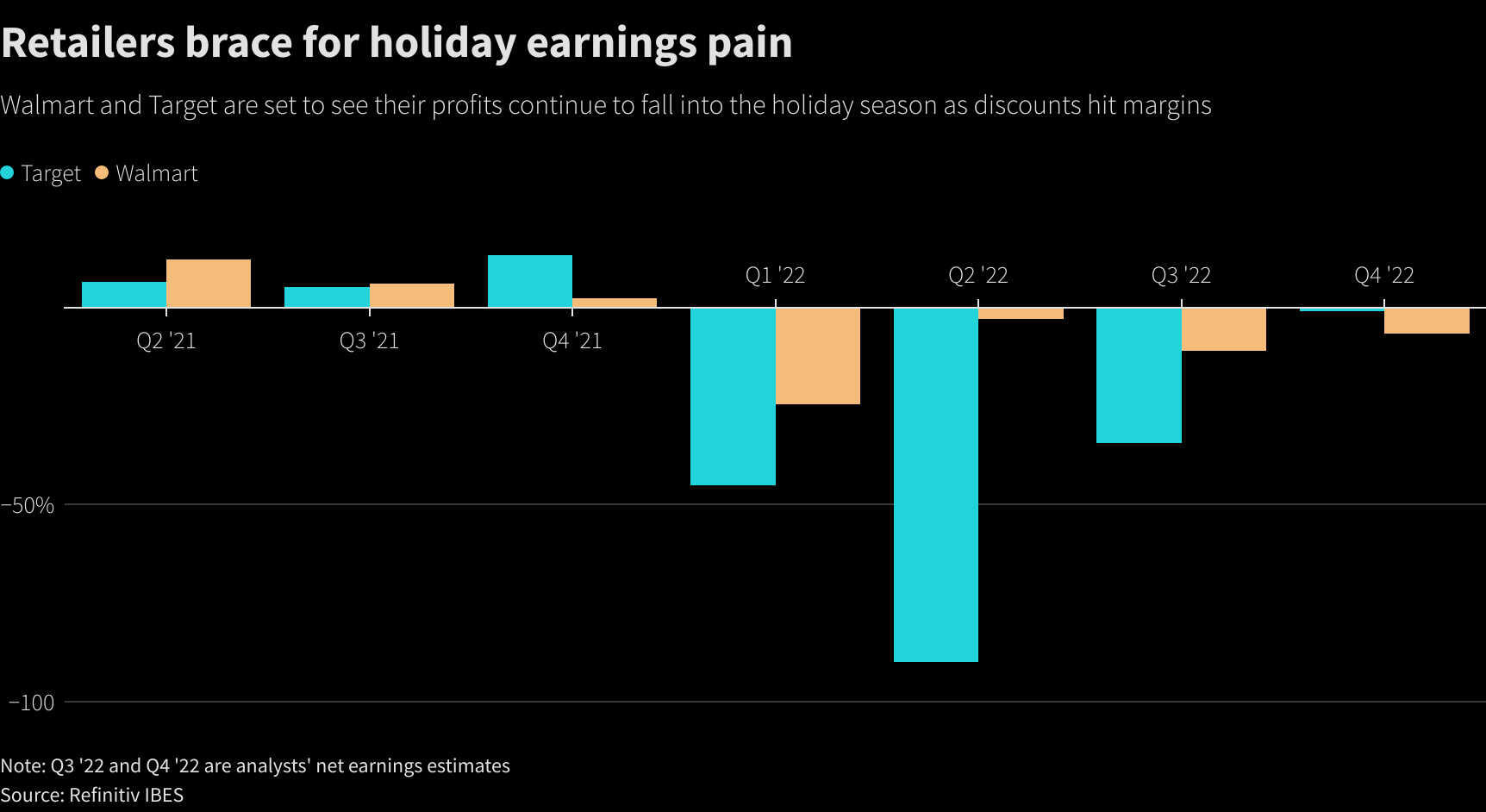

Confirmation of a softer U.S. inflaton picture will be watched closely later on Tuesday with the release of U.S. producer price data for October and a snapshot from retailers Walmart and Home Depot will give a glimpse of consumer health.

U.S. stock futures were higher ahead of the open and Treasury yields were steady.

With former President Donald Trump expected to announce another White House bid later on Tuesday, Kari Lake – one of the most high-profile Republican candidates in the midterm elections to embrace Trump’s false claims of voter fraud in 2020 – lost her bid to become the next governor of Arizona.

And in the battered world of crypto assets collapsed crypto exchange FTX outlined a “severe liquidity crisis” in official bankruptcy filings as regulators opened probes and called for the faster implementation of rules for the industry.

Key developments that may provide direction to U.S. markets later on Tuesday:

* U.S. Oct producer price index, NY Federal Reserve manufacturing index, NY Fed releases Q3 2022 Household Debt and Credit Report

* G20 summit in Bali, Indonesia

* Federal Reserve Bank of Philadelphia President Patrick Harker speaks

* US corporate earnings: Walmart, Home Depot

(By Mike Dolan, editing by XXX mike.dolan@thomsonreuters.com. Twitter: @reutersMikeD)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement