Advertisement

Advertisement

Marketmind: Fed day

By:

A look at the day ahead in markets from Dhara Ranasinghe.

A look at the day ahead in markets from Dhara Ranasinghe.

A second straight 75 basis-point interest rate hike from the U.S. Federal Reserve later on Wednesday looks like a done deal.

After all, when markets started to bet on a 100 bps move after latest inflation data, Fed policymakers reacted with a concerted push back.

But it’s not quite time to move along. What Fed chief Jerome Powell says about prospects for a September policy move will be watched closely, and could be the trigger for another bout of volatility in markets that have switched their attention to the slowing economy.

In the meantime, strong U.S. and European company earnings – notably better-than-expected results at Microsoft and Google — have lifted sentiment. European shares have opened higher, Wall Street seems set for a firmer session and Asian markets fared well earlier in the day.

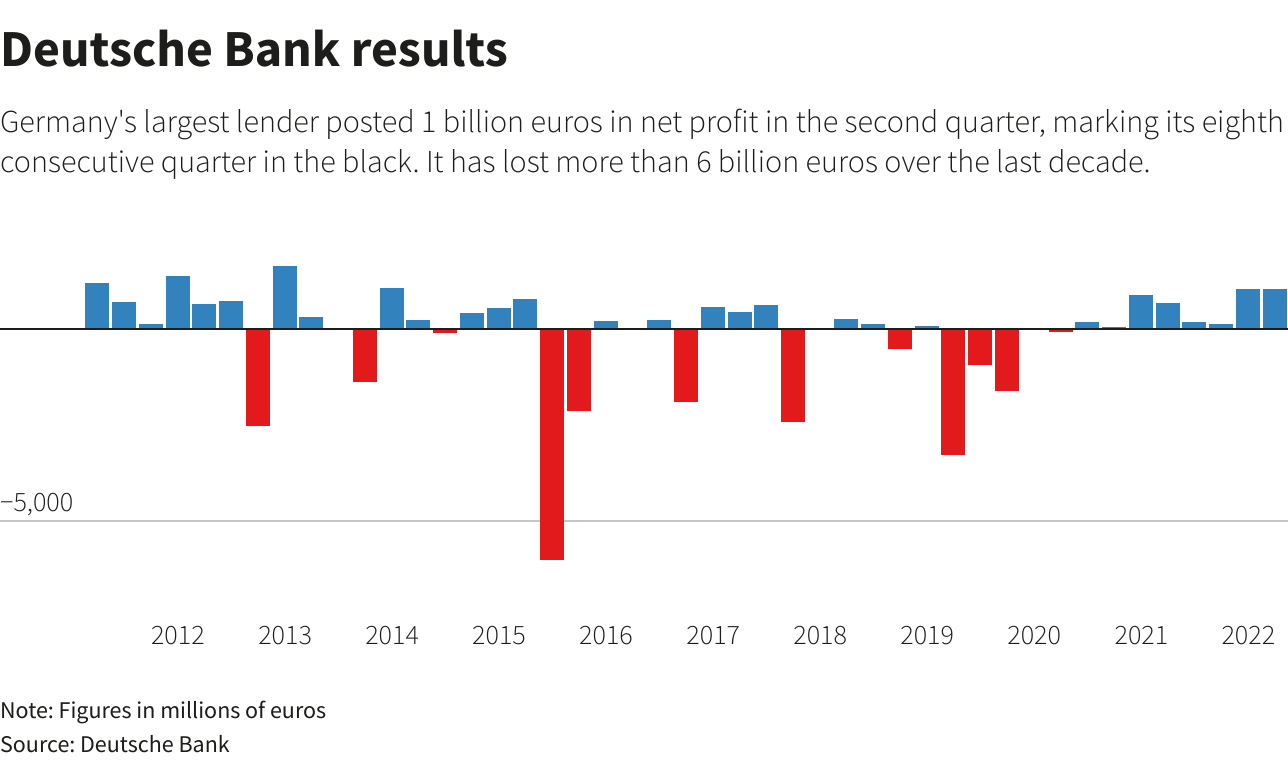

But watch what the CEOs are saying: Deutsche Bank after posting a 51% rise in second-quarter profit, was less optimistic about full-year prospects and warned about the economic outlook.

Also keep an eye on is Italy, where a surprise S&P Global decision to cut the outlook on Italy’s sovereign credit rating outlook to stable from positive has sparked another selloff in bond markets.

Key developments that should provide more direction to markets on Wednesday:

– China’s industrial profits rebound in June

– Australian inflation speeds to 21-year high, peak still to come

– Kenya’s central bank meets

– Gas supply concerns push German consumer sentiment to record low -GfK

– Euro zone June money supply data

– US June durable goods data

– U.S. earnings: Invesco, Bristol-Myers, CME Group, Kraft Heinz, Boeing, Ford, QualComm.

-Europe earnings: Airbus, Credit Suisse, Banco de Sabadell, Mercedes-Benz, Danone, Lloyds Banking Group, BAT, Rio Tinto, Deutsche Bank, EDP, Endesa, Wizz Air, Telecom Italia, GlaxoSmithKline, Poste Italiane, Carrefour, Moncler

(This story corrects German data release to consumer sentiment in key developments section, removes reference to retail sales.)

(Reporting by Dhara Ranasinghe; editing by Sujata Rao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement