Advertisement

Advertisement

S.Africa gets biggest rate hike in two decades as inflation soars

By:

JOHANNESBURG (Reuters) - South Africa's central bank raised its main lending rate more than expected on Thursday, by 75 basis points to 5.50% to try to keep a lid on inflation.

JOHANNESBURG (Reuters) -South Africa’s central bank delivered its biggest interest rate hike in two decades on Thursday to try to curb inflation, which surged to a 13-year high in June despite four previous hikes.

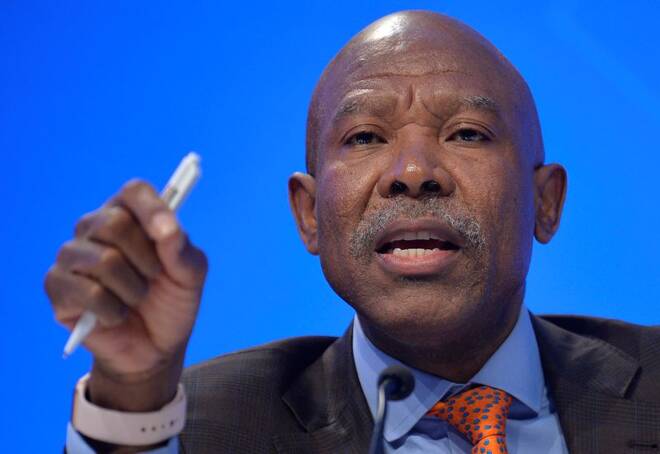

Governor Lesetja Kganyago said the South African Reserve Bank (SARB) was determined to act on rising inflation and was cognisant of the risks.

“We hear the cries of South Africans that inflation is eroding their incomes, … we are determined as the SARB to protect the incomes of South Africans,” Kganyago told a news conference.

The latest hike, by 75 basis points (bps), takes the SARB’s repurchase rate to 5.50%.

Economists had predicted a 50 bps increase, so the rand rallied after the larger hike was announced.

Thursday’s decision was split, with three monetary policy committee (MPC) members preferring the 75 bps rise, one a 100 bps increase and a last member a 50 bps lift.

It was the fifth MPC meeting in a row to raise the rate, in a hiking cycle that started in November last year.

Initially the MPC moved in 25 bps increments before a 50 bps increase at the last meeting in May.

The SARB sees headline consumer inflation this year of 6.5%, up from 5.9% in May and compared with an actual reading of 7.4% in June. It revised upwards its 2022 economic growth forecast to 2.0% from 1.7% previously, but lowered its growth forecasts for 2023 and 2024.

The SARB said its policy aimed to stabilise inflation expectations more firmly around the mid-point of its target range of between 3% and 6%, and to increase confidence the target will be hit in 2024.

Risks to the inflation outlook were to the upside and to the medium-term growth outlook were to the downside, it said.

“We remain alive to the risks on the horizon. We will continue to assess the balance of risks and we will recalibrate policy as appropriate given the data as it comes,” Kganyago said.

(Reporting by Alexander Winning, Olivia Kumwenda-Mtambo, Bhargav Acharya and Promit MukherjeeEditing by James Macharia Chege and Barbara Lewis)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement