Opinions

- FX Empire Editorial Board

The Federal Reserve has made it very clear that it wants to stop quantitative easing. But it has also made it just as clear that it won’t begin to taper its quantitative easing program until certain conditions are met. While speaking in front of the Committee on Financial Service, here’s

- FX Empire Editorial Board

In the first quarter of 2013, we saw an interesting and unexpected development. While the corporate earnings of S&P 500 companies were better than expected, their revenues weren’t nearly as impressive. Just 46% of S&P 500 companies reported revenues above estimates. (Source: FactSet, May 31, 2013.) And the second-quarter corporate

- FX Empire Editorial Board

At this point, what the stock market needs is a little time for reflection. And by that I mean that the market participants really need to sit back, pause, and examine the situation. As you already know, I was disappointed that the correction in June was not deeper—I was waiting

- FX Empire Editorial Board

“Impressive” is the only word I can think of to describe the moves of the S&P 500 and Dow Jones Industrial Average to new record highs last Thursday. Call it the “Bernanke bounce” if you want, but if you didn’t believe the Federal Reserve’s easy monetary policy was behind the

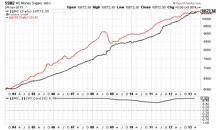

You’ve got to change with the times. One point that I’ve reiterated several times is that it’s vital to deploy an investment strategy that incorporates the current market environment when determining how to allocate one’s portfolio. A great example of that has been the recent climb and rapid drop in

One of the most common problems new investors face is learning that at certain points in an economic cycle, bad news can be seen as good news. The recent speech by the Federal Reserve chairman Ben Bernanke regarding monetary policy was seen as bullish for investor sentiment, even though he

- FX Empire Editorial Board

The equity market continues to trade while hanging on the Federal Reserve’s every word. There continues to be buoyancy in investor sentiment, and it’s flying in the face of what can only be described as modest earnings results so far. And the fervor that institutional investors have to be buyers

- FX Empire Editorial Board

Mark my words—gold bullion has a great future ahead. As the prices for gold bullion face severe headwinds in the short term, the fundamentals are getting stronger. The most important sign that makes me believe it is that central banks continue to buy more in spite of a sharp decline.

- FX Empire Editorial Board

Back in late 2011, I created a widely circulated video that included six predictions. I hit it on the head with five of those predictions. But the winners are not what are important to my readers today; it’s the prediction I didn’t get right that’s vital now Back then, I

- FX Empire Editorial Board

The Chicago Board Options Exchange (CBOE) Market Volatility Index—better known as the “VIX” or even the “fear gauge”—sits just above 14. That means investors are continuing to ignore stock market risks and, in the process, are actually assuming even more risk. All you have to do to see how much

- FX Empire Editorial Board

Two important banks just reported very solid numbers. That’s important because the financials are a very significant stock market sector that contributes tremendously to investor sentiment and the overall tone for trading action in the capital markets. Wells Fargo & Company (WFC) beat the Street with a 19% gain in

- FX Empire Editorial Board

The current market action will soon turn to selling. I’ve come to that conclusion because what the current stock market is doing is really not normal, and a correction will certainly come. I’m not saying the end is near. In fact, I feel there are more gains to come, but

- FX Empire Editorial Board

I told you so. According to the National Bureau of Statistics, the Chinese economy grew at an annual pace of 7.5% in the second quarter of this year from a year earlier—down from 7.7% in the first quarter. (Source: Bloomberg, July 15, 2013.) Regular readers of Profit Confidential shouldn’t be

- FX Empire Editorial Board

You can relax. Contrary to what you might have heard, the Federal Reserve is not going to stop printing money anytime soon. The market showed some relief last week after the Federal Open Market Committee (FOMC) meeting minutes indicated that the central bank wants to make sure the economy and

Over the last few days, the level of confusion regarding monetary policy by the Federal Reserve has increased substantially. The result has been that buyers have re-emerged in the gold market. First there was the release of the minutes from the last meeting of the Federal Reserve on June 18-19.

- FX Empire Editorial Board

The big news for the stock market this week was the lackluster results from Alcoa Inc. (NYSE/AA)—normally a decent barometer of global industrial activity. But what’s interesting is that the stock market rallied on the results. That goes against conventional wisdom. Actually, Alcoa beat estimates on revenues and earnings—but just

The time to act is close at hand. As long-time readers of my pages are aware, one of my primary concerns about the current economy has been the complacency of investor sentiment. If you look back to any period just prior to a significant market correction, what you will usually

- FX Empire Editorial Board

When it comes to petro-dollars, North Dakota isn’t the first place you might think of—but soon it will be. The aggressive efforts to develop shale oil have turned North Dakota into one of the top states for growth and employment nationwide. Since oil first started to be processed from shale

- FX Empire Editorial Board

The spot price of oil is worth keeping a sharp eye on. With West Texas Intermediate (WTI) oil having jumped past $105.00 a barrel, oil stocks are moving again. Geopolitical tensions certainly have added a bit of a premium to oil prices, but there’s been resilience in spot well over

- FX Empire Editorial Board

Did the Federal Reserve just tell us it wants much higher inflation? In the most recent meeting minutes from the Federal Open Market Committee (FOMC), it said: “Most [members], however, now anticipated that the Committee would not sell agency mortgage-backed securities (MBS) as part of the normalization process, although some