Advertisement

Advertisement

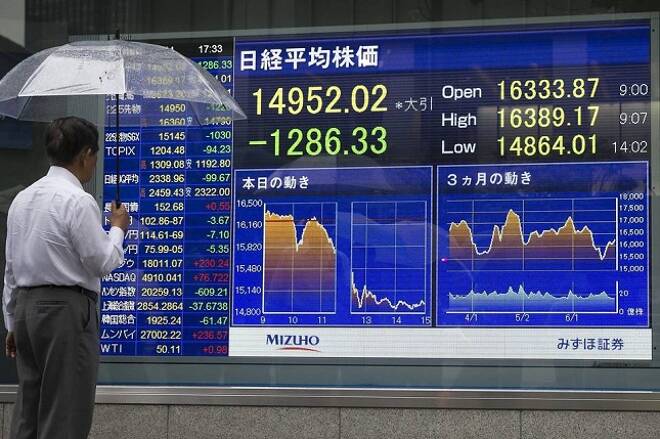

Oil Falls to 3 Month Low, Yen Surges Over 1%

By:

The USD/JPY was trading lower on Tuesday as traders reacted in disappointment to Japan policymakers new stimulus program. On Tuesday, the Nikkei reported

The USD/JPY was trading lower on Tuesday as traders reacted in disappointment to Japan policymakers new stimulus program. On Tuesday, the Nikkei reported that an estimation of 6 trillion Yen will be injected into Japan’s economy. The amount would be less than analysts’ expectations. USD/JPY is trading at 104.36, a drop of -1.12%, Nikkei closed at 16,383, down -1.43%.

The Japanese government pressures the bank of Japan to ease the economy with a further stimulus program.

On Friday, the BOJ meeting will spread light over the Japanese economy. No change in interest rate is expected as the current rate in Japan is in the negative territory. There are speculations that the fiscal BOJ stimulus program will be increased from $130 billion to $390 billion.

“The market is cautious due to the risk of policy disappointment,” said Neil Jones, head of hedge fund sales at Mizuho Bank Ltd. in London. “The BOJ may do nothing and the Fed may take on a more dovish angle.”

Oil Sinks to 3 Month Low

Oil prices continue to fall as global production and high inventory levels push the black gold further down. Crude oil is trading below $43 support level at $42.43 per barrel a drop of 1.66% while Brent Oil is trading at $44.55 per barrel down 1.33%.

Additionally, natural gas loses 1.46% and trading at $2.67, gasoline is down 1.47% trading at $1.31.

“Supply continues to return from disruptions, refined products are severely oversupplied, crude demand is falling well short of product demand, and key product demand is decelerating,” Morgan Stanley said in a note.

About the Author

Tom Chenauthor

Tom began trading currencies and commodities in 2005 which during this time he developed his approach and gained a strong understanding of the financial markets, macroeconomics, and geopolitics. He is an experienced writer with a wide knowledge of economics, politics and the financial markets.

Advertisement