Advertisement

Advertisement

Yen Rebounds on Position-Squaring Ahead of China Trade Report

By:

Asian stocks rose on Wednesday toward their highs for the year as demand for higher risk assets continued to increase amid speculation that some of the

Asian stocks rose on Wednesday toward their highs for the year as demand for higher risk assets continued to increase amid speculation that some of the world’s leading economies were in-line for additional central bank stimulus. However, the commodity-linked Australian and New Zealand Dollars weakened ahead of key trade data from China and the Japanese Yen posted a gain versus the U.S. Dollar after a steep two-day decline.

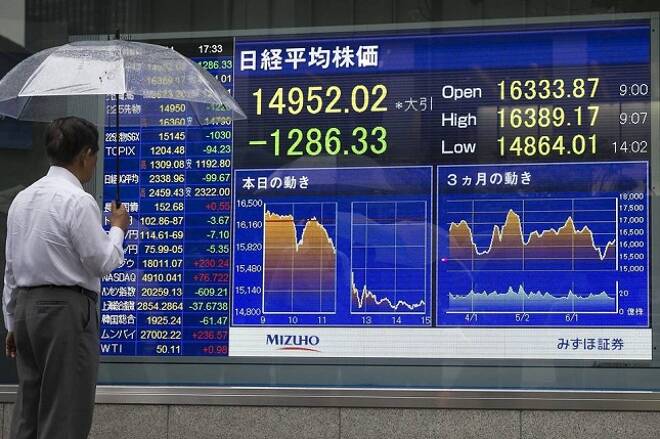

The MSCI Asia Pacific Index rallied for a third day after global equities returned to levels seen before the U.K.’s June 23 vote to leave the European Union. Japan’s shares also rose as the government prepares measures to revive the world’s third-largest economy. The MSCI Index climbed 0.9 percent, moving to within 1 percent of its highest close this year. Japan’s Topix Index gained 1.3 percent in addition to a 6.3 percent gain earlier this week.

In Japan, the Nikkei 225 was up 1.2 percent, extending Monday and Tuesday’s combined 6.5 percent rally trading at 16210.

Following a landslide election over the week-end, Japanese Prime Minister Shinzo Abe ordered up more fiscal stimulus. Abe has ordered his economy minister to compile stimulus measures this month, while the Sankei newspaper reported government officials are considering “helicopter money” as a policy option. Chief Cabinet Secretary Yoshihide Saga also said such a policy would involve the central bank directly financing government spending.

The NZD/USD retreated from a one-year high and the AUD/USD broke from near its strongest level in two months ahead of a Chinese trade data report. It is expected to show declines in both exports and imports for June.

In other news from Australia, the Westpac-Melbourne Institute survey of consumer sentiment fell 3% in July, following a decline of 1% in May. However, investors were quick to point out that the survey took place amid election uncertainty.

In Japan, the Ministry of Economy, Trade and Industry said in a report on Wednesday that industrial output declined 2.6% in May following strong gains in the previous two months. The decline was worse than the median estimate of economists, which projected a 2.2% drop. In annualized terms, industrial production fell 0.4%, official data showed.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement