Advertisement

Advertisement

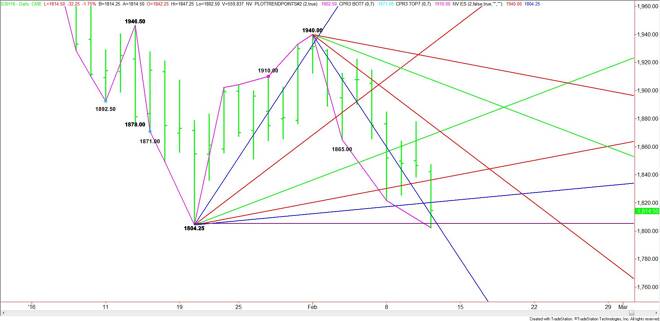

E-mini S&P 500 Index (ES) Futures Technical Analysis – February 11, 2016 Forecast

By:

March E-mini S&P 500 Index futures are called sharply lower based on the pre-market trade. The earlier selling stopped at 1802.50, slightly below the

March E-mini S&P 500 Index futures are called sharply lower based on the pre-market trade. The earlier selling stopped at 1802.50, slightly below the previous swing bottom at 1804.25. This reaffirmed the downtrend.

If 1802.50 is taken out with conviction later in the session then look for an acceleration to the downside with 1774.00 the next likely downside target.

The nearest downtrending angle to watch is a steep angle at 1812.00. This price is likely to act like a pivot today.

Trader indecision will likely mean that traders will straddle the angle all session. This will create a choppy, two-sided intraday trade.

A sustained move under 1812.00 will indicate the presence of sellers. A sustained move over this angle will indicate that short-covering is taking place.

Today is the eighth day down from the 1940.00 main top so we are in the window of time for a closing price reversal bottom. It will take an extremely strong rally to reverse today’s market, but traders should be aware of it. The key intraday level to watch is the mid-point of today’s range at 1825.00. Overtaking this level could make some of the shorts nervous and this could fuel a strong short-covering rally into the close.

Watch the price action and read the order flow at 1812.00. Trader reaction to this angle will determine the direction of the market the rest of the session.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement