Advertisement

Advertisement

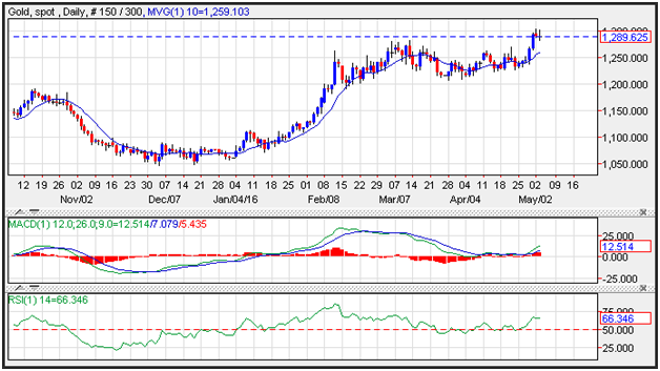

Gold Price Prediction for May 3, 2015

By:

Gold prices moves higher initially during the Asia trading time zone following the softer than expected Chinese PMI data. Prices reversed course and

Gold prices moves higher initially during the Asia trading time zone following the softer than expected Chinese PMI data. Prices reversed course and generated a doji day which reflects indecision. Support is seen near the 10-day moving average at 1,259, while resistance is seen near the 1,306 level. Momentum has turned positive as the MACD (moving average convergence divergence) index prints in the black with an upward sloping trajectory which points to higher price for the yellow metal.

China’s Caixinmanufacturing PMI fell to 49.4 in April from 49.7 in March, contrary to an expected small improvement. The sub-50 reading in April marks the fourteenth consecutive contractionary reading for this index. The output index fell to 49.9 in April from 50.4 in March. The separately released official government complied manufacturing PMI, out yesterday, edged lower to 50.1 in April from 50.2 in March.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement