Advertisement

Advertisement

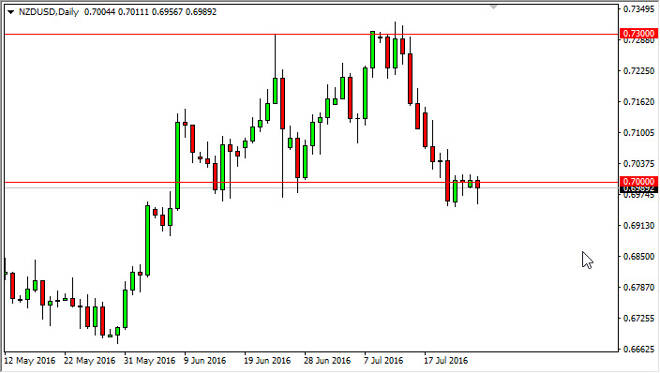

NZD/USD Forecast July 26, 2016, Technical Analysis

Published: Jul 26, 2016, 04:35 GMT+00:00

The NZD/USD pair initially fell during the course of the day on Monday, but turned right back around to form a hammer. The 0.70 level has been a fairly

The NZD/USD pair initially fell during the course of the day on Monday, but turned right back around to form a hammer. The 0.70 level has been a fairly significant support level in this market several times, and the fact that we ended up forming a hammer suggests that perhaps we are going to bounce yet again. We have sold off rather drastically lately, so a break above the top the hammer, and more importantly a break above the last several candles which means that the market should break above resistance and continue to go higher.

On the other hand, we could break down below the bottom of the hammer, and that will probably have this market attacking the 0.69 level below. If we get below that area, the market should then go to the 0.67 handle. With this, a break below that candle would increase the momentum to the downside, but I still believe that more than likely we will continue to go higher. The New Zealand dollar continues to be attracted to bullish pressure in the commodity markets, as the Kiwi dollar tends to follow the general attitude of commodity markets. If we start seeing quite a bit of bullish pressure and various commodity markets, that could be reason enough for the Kiwi go higher.

I do see that several commodities right now look like they are trying to approach some type of support, so a bounce from there will more than likely continue to go higher over the longer term. This is especially true in the precious metals markets, although I am the first to admit that the Kiwi tends to follow agricultural markets a little closer. Nonetheless, there is a bit of a “knock on effect” when the Australian dollar pops due to the gold markets. With this, I fully anticipate that the market will bounce, but I do recognize I need the trigger move of breaking over the Thursday and Friday candles of last week as it is the technical signal many traders will be paying attention to in this particular pair.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement