Advertisement

Advertisement

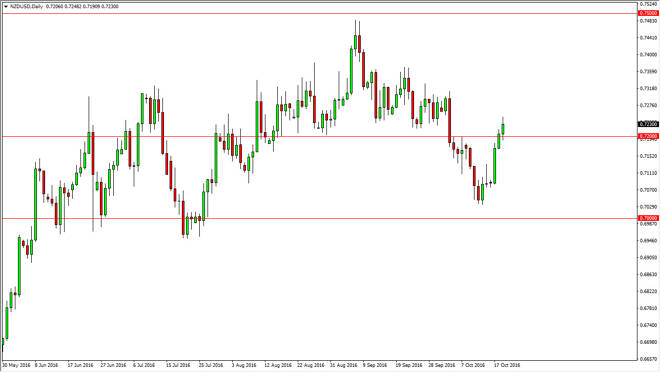

NZD/USD Forecast October 20, 2016, Technical Analysis

Published: Oct 20, 2016, 04:55 GMT+00:00

The New Zealand dollar went back and forth during the day on Wednesday after breaking above the 0.72 level which has been previous resistance. The candle

The New Zealand dollar went back and forth during the day on Wednesday after breaking above the 0.72 level which has been previous resistance. The candle is positive though, so we could very well find ourselves reaching a little bit higher before the longer-term sellers get involved. If we get an exhaustive candle or if we can break back below the bottom of the range for the day on Wednesday, I would be willing to sell as the market will probably try to reach towards the 0.7050 level below. I think that the resistance runs all the way to the 0.7350 level above, so it’s not until we break above there that I’m comfortable buying the New Zealand dollar. Remember, the Kiwi dollar tends to be very heavily influenced by risk appetite in general, and that of course can express itself in the stock markets and commodity’s markets also.

Because of this, I think that the market will tend to be very volatile but it certainly seems as if the sellers have taken control this market as of late. In fact, you can even make an argument for an uptrend line that was broken and now is being tested again. That quite common when you see the market turned over, and that could send this to much lower levels given enough time. It is a market that will be very volatile due to the fact that risk appetite is all over the board right now, but I think that it is only a matter of time before the sellers come back overall and continue to punish the New Zealand dollar due to the fact that there is so much uncertainty in the world right now.

If we did break out to the upside, once we get above the 0.7350 level, I think the market would then be attracted to the 0.75 level above, which has been resistance in the past, and of course an area that the market will be paying attention to because it is such a large, round, psychologically significant handle.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement