Advertisement

Advertisement

Technical Outlook: EUR/USD, GBP/USD, NZD/USD And USD/CHF

By:

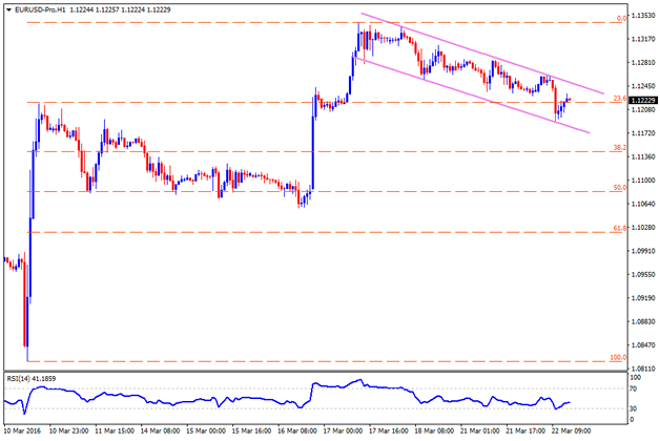

EUR/USD Following its inability to sustain the six month old trend-line break, the EURUSD continue portraying the short-term descending trend-channel;

EUR/USD

Following its inability to sustain the six month old trend-line break, the EURUSD continue portraying the short-term descending trend-channel; however, a break above the channel resistance, presently at 1.1255-60, can quickly trigger its upside to 1.1300 round figure mark prior to challenging the last week’s high, near 1.1340. Should the pair mange to extend the northward trajectory beyond 1.1340, the February highs of 1.1380 and the 1.1500 round figure mark, are likely consecutive resistances that it could test. Alternatively, the channel support of 1.1180 and the 1.1100 are likely nearby support levels that the pair might rest at, breaking which 1.1050 and the 1.1000 numbers could hold the pair’s further downside. Moreover, a clear drop of 1.1000 can magnify the pair’s weakness to make it test 1.0950 and the recent lows of 1.0850.

Even if the GBPUSD failed to hold the 1.4500 break, the short-term ascending trend-channel continue favoring the pair’s upside unless it breaks the 1.4120 support-line, which if broken can drag the prices to 1.4050 and the 1.3900 numbers. Given the pair’s continuous downside below 1.3900, it becomes weaker enough to neglect February lows of 1.3835 and can plunge to 1.3650 support mark. On the upside, 38.2% Fibonacci Retracement of its December 2015 – February 2016 downside, near 1.4370, and the 1.4450, are likely immediate resistances that the pair might witness during its bounce. Should it stretch the recovery beyond 1.4450, the 1.4530-50 area, comprising channel resistance and the 50% Fibo, becomes an important area for the pair traders to watch. If the pair clears the 1.4550, chances of its rally to 1.4700 mark, near to the 61.8% Fibo level, can’t be denied.

NZD/USD

NZD/USD daily chart, March 22, 2016

Repeated defeats to clears the 0.6880 – 0.6900 horizontal area seems again dragging the NZDUSD down to 0.6700 adjacent support, breaking which 200-day SMA, at 0.6620 now, 0.6560 and the 0.6500 are likely consecutive downside numbers that it might rest at prior to re-visiting the 0.6420 – 0.6400 support-area. If at all the pair drops below 0.6400 on a closing basis, it becomes vulnerable enough to test 0.6340 and the September 2015 lows of 0.6240. Meanwhile, 38.2% Fibonacci Retracement of its April – September 2015 downside, at 0.6810, followed by the 0.6880 – 0.6900 zone, can continue restricting the pair’s near-term advance. Further, pair’s capacity to sustain the 0.6900 break enables it to clear the 0.7000 psychological magnet and can head for 0.7080 resistance level.

USD/CHF

Although four month old descending trend-line continue confining the USDCHF’s downside, the pair presently seems finding it difficult to clear the 0.9700 mark, indicating another attempt towards breaking the mentioned trend-line, at 0.9640 now. If the pair dips below 0.9640, the 0.9580 might act as buffer support for the pair before it drops to 0.9480 and the 0.9380. Moreover, sustained south-run below 0.9380 can fetch the pair towards re-testing August 2015 lows of 0.9260. On the contrast, pair’s closing break of 0.9700 needs to clear the 0.9795 – 0.9800 area, encompassing 50% Fibonacci Retracement of its August – November 2015 upside and the 200-day SMA, in order to aim for 0.9850 and the 38.2% Fibo level of 0.9920. Given the successful trading above 0.9920, the 1.0000 psychological magnet becomes an important number for the pair traders to watch, clearing which it can rise towards 1.0100 area.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement