Advertisement

Advertisement

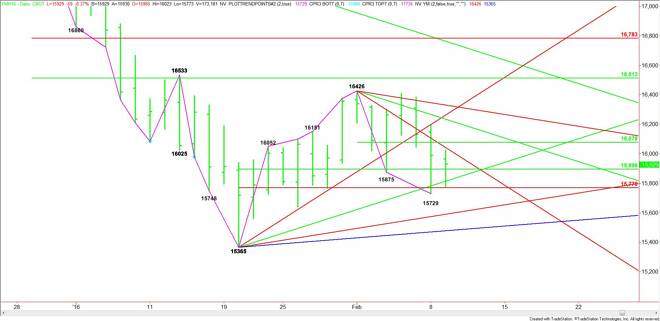

Trade of the Day – March Dow Jones Industrial Average – February 9, 2016

By:

March Dow Jones Industrial Average futures are trading slightly lower while posting an inside move. This chart pattern typically indicates trader

March Dow Jones Industrial Average futures are trading slightly lower while posting an inside move. This chart pattern typically indicates trader indecision and impending volatility. We’re interested in trading the volatility today.

The main range is 15365 to 16426. Its retracement zone is 15896 to 15770. The market straddled this zone on Monday and earlier today. This could be indicative of accumulation. If accumulation is taking place then buyers are coming in to support the market.

If upside momentum continues to build throughout the session then it may trigger a breakout through the steep downtrending angle at 16042. This price is our trigger point today for an acceleration to the upside.

The first upside target will be a short-term pivot price at 16078. Taking out this level with authority could trigger a further rally into the next potential upside target at 16234.

If the consolidation inside 15896 to 15770 continues today and a late session rally begins then look for buyers to make a run at the downtrending angle at 16042. Watch the price action and order flow on a test of this level. Taking it out with conviction could trigger a surge into at least 16078 and perhaps 16234 if the buying is strong enough.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement