Advertisement

Advertisement

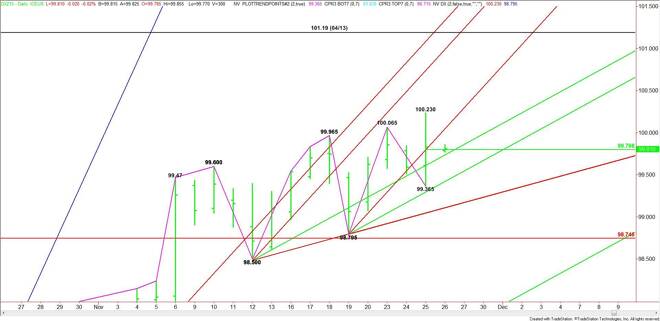

US Dollar Index (DX) Futures Technical Analysis – November 26, 2015 Forecast

By:

December U.S. Dollar Index futures spiked to the upside on Wednesday after the Euro sold-off sharply. The move in the Euro was triggered by a report from

December U.S. Dollar Index futures spiked to the upside on Wednesday after the Euro sold-off sharply. The move in the Euro was triggered by a report from Reuters that outlined the European Central Bank’s plan to inject more stimulus into the Euro Zone economy.

The main trend is up according to the daily swing chart. The trend was reaffirmed when the index took out a pair of tops at 99.965 and 100.065. A new swing bottom was formed at 99.365.

The index broke back under the break out levels, suggesting that the move was fueled by buy stops rather than aggressive buying. The new short-term range is 99.365 to 100.23. Its 50% level or pivot at 99.80 is likely to control the market over the short-term.

Based on Wednesday’s close at 99.83, the direction of the market today is likely to be determined by trader reaction to the pivot at 99.80.

A sustained move over 99.80 will signal the presence of buyers. This could create enough upside momentum to challenge the nearest uptrending angle at 100.05. Overcoming this angle will put the index in an extremely bullish position if buyers come in to support the move.

The first target over 100.05 is Wednesday’s high at 100.23. This is also a trigger point for another acceleration to the upside.

A sustained move under 99.80 will indicate the presence of sellers. This could lead to a quick break into an uptrending angle at 99.75. This angle is also a trigger point for the start of a steep break with the next targets an uptrending angle at 99.42 and a main bottom at 99.365.

Watch the price action and read the order flow at 99.80 today. Trader reaction to this angle will tell us whether the bulls or the bears are in control. Volume is expected to be light today because of the U.S. holiday so be careful buying strength and selling weakness. Let the market come to you and try to avoid chasing any moves.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement