Advertisement

Advertisement

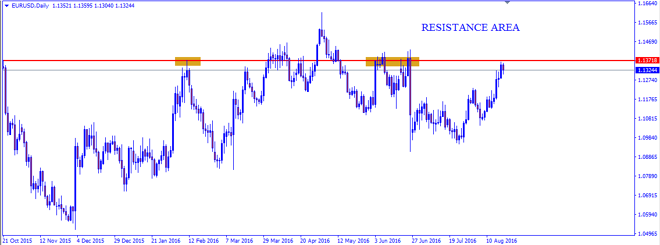

Weekly Technical Outlook: EUR/USD ; Market Forecasts for August 22nd – August 26th

Published: Aug 22, 2016, 07:10 GMT+00:00

Resistance level 1.1371 Pivot Level 1.1313 Support Level 1.1239, 1.1188, and 1.1131 Technical Analysis The EUR/USD pair attempted to breach the 1.1371

- Resistance level 1.1371

- Pivot Level 1.1313

- Support Level 1.1239, 1.1188, and 1.1131

Technical Analysis

The EUR/USD pair attempted to breach the 1.1371 levels keeping the stability of the daily close below it until the end of the week, which in turn kept the correctional bearish trend scenario valid until now. The pair is waiting to resume the bearish wave that would target 1.1239 followed by 1.1188 levels on the near term basis.

It is important to note that a retest of 1.1313 levels will complete conformation, thus pushing the price to test the most important support for the short term trading at 1.1239 direct before any new attempt to change directions.

This reminds us that these levels represent the next trend keys, with price action signalling two bar reversal and a bearish momentum at negative stability below resistance area.

Stochastic settles clearly within the 82.0 areas to support the attempts to gather a negative momentum and confirm any attempt to reach the waited target. Therefore, our bearish trend expectations will remain valid and active on the short term basis, and the targets begin by surpassing 1.1239 level to open way towards targeting the next main station. Be aware that a breach of this level will retest and turn the price to the bearish channel again, thus leading the trading to a down side on the short and medium term basis.

Economic

- Markit PMI Composite, Markit Manufacturing PMI

- Markit Services PMI

- Chicago Fed National Activity Index, New Home Sales

- Existing Home Sales, Jackson Hole Symposium, Durable Goods Orders, Initial Jobless Claims

- Fed’s Yellen Speech, Reuters/Michigan Consumer Sentiment Index

Area of Interest

- Strong resistance at 1.1371 area and closed below resistance levels.

- Bearish two bar reversal rejection on trend line.

- Price action closed below trend line and oscillator below 82.0 levels indicating shift in momentum.

- At Flip Area on Daily time frame resistance levels.

For more detailed analysis from the author, please visit NoaFX.

About the Author

Sylvester Stephencontributor

Advertisement