Advertisement

Advertisement

USD/CAD Forecast for December

Updated: Mar 5, 2019, 14:40 GMT+00:00

USDCAD has been in a steep rally since December 7th, exactly 2 weeks ago, when it opened at 1.33665 and closed at 1.34975. That day’s rally took price

USDCAD has been in a steep rally since December 7th, exactly 2 weeks ago, when it opened at 1.33665 and closed at 1.34975. That day’s rally took price past its previous high of September 29th at 1.34565, and lead to another 9 days of continued price increases. Current levels have not been seen since May 2004.

The Governor of the Bank of Canada Poloz gave a speech on December 8th where he mentioned that the central bank was open to the idea of using negative interest rates. He also stated he did not believe it would be necessary and that he expected the Canadian economy to pick up speed in 2016 and reach full capacity by 2017.

However he did state it is better to be prepared in case it is necessary, citing a market meltdown similar to that of 2008. In the event negative interest rates here necessary he said that they would not go below –0.50%. His words where mainly of caution but also opened up the possibility to the fact that interest rates could go down again, even if they do not become negative.

His comments were read as Bearish for the CAD and seen as a warning that interest rates may need to go lower; the lowest level of interest rates in Canada was at 0.25% between 2009 and 2010. Lower interest rates in Canada will only weaken that currency, in particular against the USD which is now entering a new phase of higher interest rates. The interest rate in Canada is currently set at 0.50%.

The Bank of Canada is set to meet again on January 20th 2016 at its regular monetary policy meeting. A decision on any change in interest rates will be announced at 2pm and a monetary policy statement will be released, which will communicate explanations of any decision that may have been taken.

Tomorrow we will have some important economic data released from the US. GDP will be released at 12:30 pm with an expected number of 2.1% annualized for Q3. On Wednesday we will see Durable Goods Orders data released at 12:30pm with an expected -0.7% after previous data at 3.0%

We can expect to see considerable volatility over the next two days if any of the data releases are very different to their expected levels. USDCAD has also seen price action move solely in one direction for 10 days in a row. We may begin to see choppier price action now for a few days as the Bulls and the Bears battle it out at these new levels, which were reached so quickly.

which gives you the right to buy USDCAD at a pre-set price (strike), for a pre-set date (expiry) and for an amount of your choice.

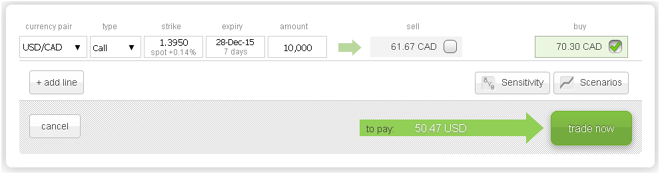

The screen shot below shows that a Call option on USDCAD with a strike of 1.3950, expiry 7 days and for $10,000 would cost $50.47, which would also be the maximum possible loss.

This screenshot shows the Profit and Loss profile of the above Call option, which you may obtain by clicking the Scenarios button.

If on the other hand you think USDCAD will retrace back down, then you may consider buying a Put option which gives you the right to sell USDCAD at a pre-set strike and expiry for an amount of your choice.

The screenshot below shows a Put option on USDCAD with strike 1.39, expiry 7 days and for $10,000 would cost $46.52, which would also be the maximum possible loss.

This screenshot shows the Profit and Loss profile of the above option.

Risk warning: Forward Rate Agreements, Options and CFDs (OTC Trading) are leveraged products that carry a substantial risk of loss up to your invested capital and may not be suitable for everyone. Please ensure that you understand fully the risks involved and do not invest money you cannot afford to lose. Our group of companies through its subsidiaries is licensed by the Cyprus Securities & Exchange Commission (Easy Forex Trading Ltd- CySEC, License Number 079/07), which has been passported in the European Union through the MiFID Directive and in Australia by ASIC (Easy Markets Pty Ltd -AFS license No. 246566).

This article is a guest blog written by easy-forex

About the Author

Advertisement