Advertisement

Advertisement

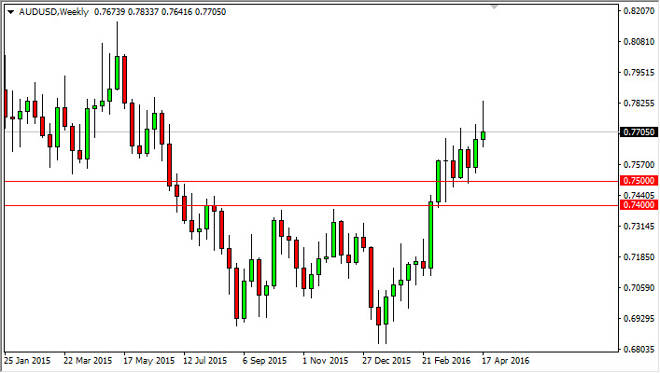

AUD/USD forecast for the week of April 25, 2016, Technical Analysis

Updated: Apr 23, 2016, 04:19 GMT+00:00

The AUD/USD pair broke higher during the course of the week, and then turned back around to form a massive shooting star. That being the case, the market

The AUD/USD pair broke higher during the course of the week, and then turned back around to form a massive shooting star. That being the case, the market looks as if we could pull back from here, but we do see a significant amount of support below at the 0.75 level. With this, the market may offer short-term selling opportunity, but as far as long-term trades are concerned you’re probably going to be better served staying on the sidelines and waiting for a more significant signal. Ultimately, this is a market that tends to follow the gold markets, which are essentially going sideways at this point in time.

If we do pullback, a supportive candle in this general vicinity should be a nice buying opportunity. When you look at the weekly chart, you can see that there is a lot of noise above the 0.77 level extending all the way to the 0.80 level. This was early in 2015, so this is previous “market memory” coming into play, and there will more than likely be quite a bit of order flow in this general vicinity.

If we break above the top of the shooting star, that would be a sure sign of strength, and could send this market looking for the aforementioned 0.80 level again. With this being the case, the market looks as if it is going to make some type of strong decision soon, and it could be in concert with the gold market, keep that in mind please. Ultimately, the 0.80 level above is a very important number from the longer-term charts, and as a result we would be very interested to see what happens in that general vicinity.

It is not until we break down below the 0.74 level that we could even consider selling this market for any real length of time, although we recognize that would be a very choppy move as well. The Australian dollar has been sold off rather drastically over the last couple of years, and perhaps now people are starting to question as to whether or not it has been unjustly done.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement