Advertisement

Advertisement

Crude Oil Forecast February 15, 2016, Technical Analysis

Updated: Feb 13, 2016, 06:04 GMT+00:00

Light Sweet Crude The light sweet crude market rose during the day on Friday, after gapping higher at the open. With that being the case, the market looks

Light Sweet Crude

The light sweet crude market rose during the day on Friday, after gapping higher at the open. With that being the case, the market looks as if it is trying to reach towards the $30 level. That level of course is a large, round, psychologically significant number, but it is also an area that used to be supportive previously. Ultimately, this is a market that should continue to see a resistive pressure above. An exhaustive candle above should be a selling opportunity, and we would more than willing to start selling yet again. The market should then continue to go lower, probably to the $25 level next which of course is the next large, round, psychologically significant number. In fact, we see nothing but massive amounts of resistance all the way to the $34 level.

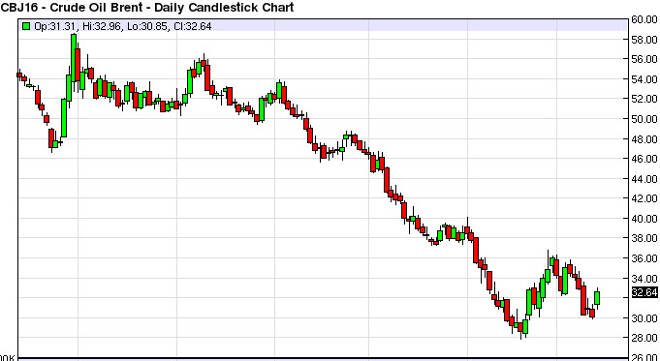

Brent

Brent markets gapped higher at the open on Friday, as we got quite a bit of bullish movement. However, there is so much in the way of resistance above that we do not see any opportunity to buy this market anytime soon. This is a market that should continue to see sellers enter every time there is a bit of a rally, and we think that this is simply going to be a bit of a “relief rally” and nothing more.

At this point in time, the market should continue to see quite a bit of resistance all the way to at least the $40 level, and it would have to break above there on a daily close for us to even consider buying at this point. Ultimately, the market should continue to go much lower, and I believe that this market will reach all the way down to the $25 level given enough time. Rallies are short-term anomalies at this point in time and this of course can be looked at as and an inefficiency in the market. In the meantime, we could get a little bit of a move higher but we are more than willing to simply wait for our shorting opportunity.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement