Advertisement

Advertisement

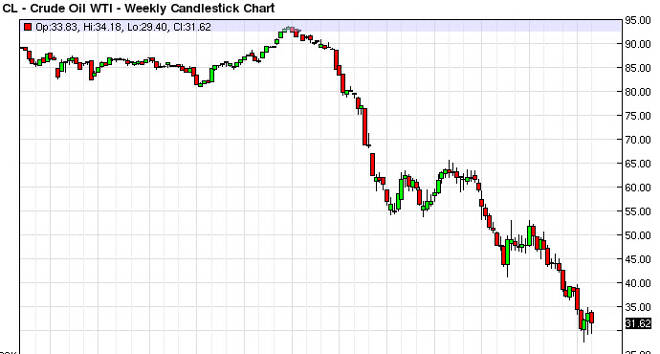

Crude Oil forecast for the week of February 8, 2016, Technical Analysis

Published: Feb 6, 2016, 05:57 GMT+00:00

Light Sweet Crude The light sweet crude market fell during the course of the week, but found enough support at the $30 level to turn things around and

Light Sweet Crude

The light sweet crude market fell during the course of the week, but found enough support at the $30 level to turn things around and form a hammer. By doing so, it looks like the market is trying to break out to the upside for the short-term, but we need to get above $35 for any real strength or follow-through comes into play. At that point, it appears that being long could pay off for a candle or so, but ultimately we are without a doubt in a very negative market. The $40 level should be resistive, and as a result we think that it’s probably going to be easier to simply wait until we get a resistive candle above the search selling yet again. Pay attention to the US dollar, because if it strengthens more than likely we will continue to see weakness in this market.

Brent

Brent markets initially tried to fall during the course of the week but turned around to form a hammer. That hammer of course is bullish but we see pretty significant resistance at the $40 level, and of course the $45 level. Ultimately, this is a market that is in a massive downtrend, and that being said the market is most certainly one that we feel much more comfortable selling than buying. If we get an exhaustive candle were break down below the bottom of the hammer for the week, we continue to punish the Brent market as the supply is far too strong for the demand.

Any rally at this point in time should be considered to be a “relief rally”, and as a result should prove itself to be very tempting for short sellers as the massive downtrend has been so profitable for them. The bounce that we’ve seen recently has been the $30 level, which of course has a certain amount of psychological significance. With that being the case, it’s only a matter of time before we turned back around and trying to build up enough momentum to break down through that region.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement