Advertisement

Advertisement

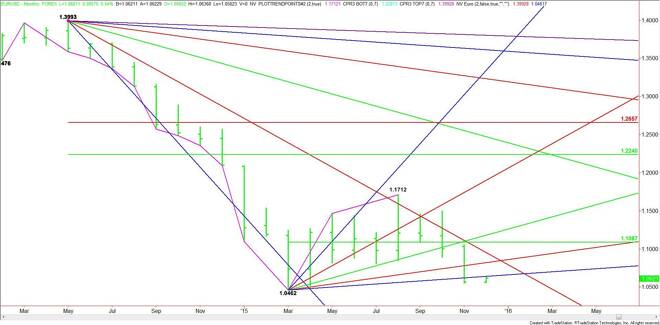

EUR/USD Monthly Technical Analysis for December 2015

By:

The EUR/USD closed at its lowest level since April, putting it in a position to challenge the low for the year at 1.0462. The sell-off in November was

The EUR/USD closed at its lowest level since April, putting it in a position to challenge the low for the year at 1.0462. The sell-off in November was fueled by expectations of a rate hike by the Fed this month and the prospect of further stimulus from the European Central Bank.

Look for volatility on December 3 in conjunction with the ECB policy meeting and on December 16 with the release of the Fed monetary policy statement and the widely expected rate hike. The ECB is expected to announce new stimulus measures that are designed to boost inflation.

Technically, the main trend is down according to the monthly swing chart. The short-term range is 1.0462 to 1.1712. Its 50% level or pivot is at 1.1087.

Based on the November close at 1.0564, the direction of the market this month is likely to be determined by trader reaction to the uptrending angle at 1.0642.

A sustained move over this 1.0642 will indicate that buyers are coming in to defend the main bottom at 1.0462. This could create enough upside momentum to challenge the next uptrending angle at 1.0822.

Overtaking the angle at 1.0822 will indicate that the buying is getting stronger. This could occur if the ECB disappoints with a lame proposal. The next target is the downtrending angle that has guided the EUR/USD lower since the 1.3993 top from May 2014.

A sustained move under 1.0642 will signal the presence of sellers. This could create enough downside momentum to challenge the main bottom at 1.0462. This bottom will likely be taken out with conviction if the ECB plan is more hawkish than previously expected.

Watch the price action and read the order flow at 1.0642 today. Trader reaction to this angle will tell us whether the bears are still in control or if the strength is shifting to the bulls.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement