Advertisement

Advertisement

Important GBP Pairs: Technical Update

By:

GBP/USD Although GBPUSD’s gradual recovery from 1.2135-30 multiple-support-zone pleased some of the counter-trend traders, the 1.2325-30 horizontal-line,

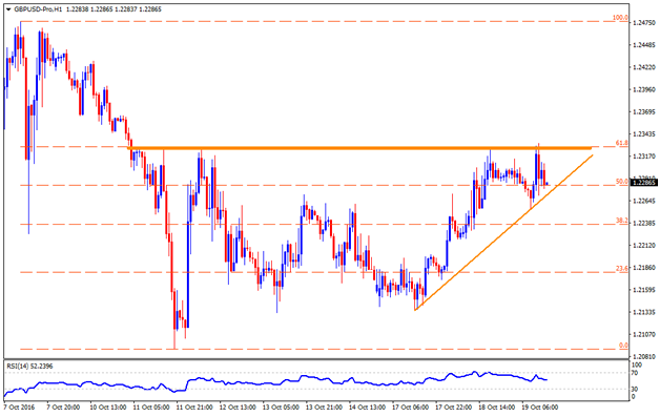

GBP/USD

Although GBPUSD’s gradual recovery from 1.2135-30 multiple-support-zone pleased some of the counter-trend traders, the 1.2325-30 horizontal-line, also including 61.8% Fibonacci retracement of its recent downtick, continue restricting the pair’s upside; however, an immediate upward slanting trend-line support of 1.2265 acts as a trigger to witness its fresh decline. Considering the pair’s repeated failures to clear 1.2325-30, chances of its drop to 1.2220 are more likely on the break of 1.2265 while further downside of the quote below 1.2220 can reprint 1.2180 rest-point. Given the pair continue trading below 1.2180, the 1.2135-30 might act as intermediate halt during its plunge to 1.2090 and then to the 1.2000 psychological magnet. On the upside, a clear break of 1.2330 can activate the pair’s rally to 1.2365 and then to the 1.2400 round figure before fueling it to 1.2480, which if broken enables the pair traders to aim for 1.2530 and the 1.2600 resistance levels.

EUR/GBP

Unlike GBPUSD, the EURGBP gives more confirmation of further downside as a short-term descending trend-line remains present on the chart while the pair slowly dips from 0.9255. Currently, 23.6% Fibonacci Retracement of its June – October upside, at 0.8860, could act as nearby support for the pair before the pair can test 0.8800 round figure; though, its further declines are confined by a medium-term ascending TL mark of 0.8790, which if broken can fetch the price to 0.8715-20 horizontal support. If the pair keep on declining below 0.8715, the 38.2% Fibo level of 0.8620 and the 0.8560 are likely figures to appear on the chart. In case if the pair clears the immediate 0.8995 – 0.9000 TL resistance, it can quickly rise to 0.9040 and the 0.9130 prior to raising hopes for 0.9250 mark. Should the pair continue trading high beyond 0.9250, the 0.9310 and the 0.9420 can entertain the Bulls.

GBP/JPY

GBPJPY presently tests a short-term support-line at 126.85, breaking which it could dip to 126.15-20 and to the 125.80 while pair’s additional weakness below 125.80 can make it see 125.30 and the 124.80 levels ahead of reprinting present month lows around 122.80. Should the pair-bears command its move below 122.80, chances of witnessing 120.00 can’t be denied. Alternatively, 127.80 and the 128.50 can offer nearby resistances to the pair prices, breaking them might favor its upside to a month-old descending trend-line of 129.50. Given the successful break of 129.50, the pair can quickly flash 130.50 and the 131.30 on the chart.

GBP/CHF

Having failed to clear last week’s high around 1.2200, the GBPCHF seems now declining towards 1.2100 re-test, breaking which 1.2025 and the 1.1990, followed by 1.1950, might offer rest-points during the pair’s south-run. Given the pair breaks 1.1950, it might witness 1.1850 and the 1.1700 as intermediate halts prior to revisiting the “Flash-Crash” low of 1.1616. Meanwhile, a break of 1.2200 can trigger the pair’s upside to 23.6% Fibonacci Retracement of June – October downturn, at 1.2295, but three-month old descending trend-line mark of 1.2330 could restrict its further advances. In case if the pair manage to surpass 1.2330, it becomes capable to flash 1.2490-95 horizontal resistance area.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement