Advertisement

Advertisement

Technical Update: Important CHF Pairs

By:

USD/CHF With the 50-day SMA successfully restricting USDCHF upside, the pair now seems declining to its 0.9680 immediate support, breaking which 0.9660

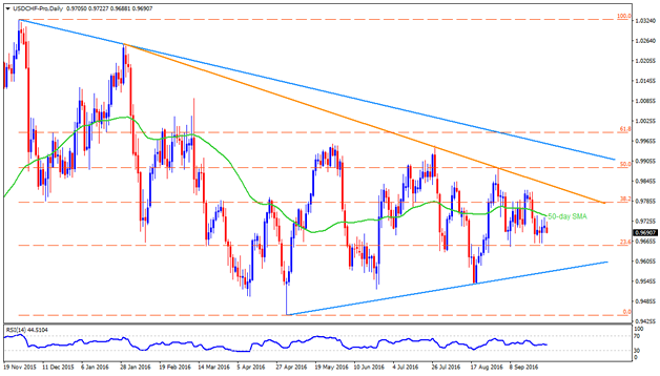

USD/CHF

With the 50-day SMA successfully restricting USDCHF upside, the pair now seems declining to its 0.9680 immediate support, breaking which 0.9660 and the 0.9620 are likely following downside figures to appear on the chart. Given the pair maintain its downturn below 0.9620, nearly six-month old ascending trend-line support of 0.9570 and the 0.9530 could come-back prior to flashing importance of May lows of 0.9440. On the upside, 50-day SMA level of 0.9740 and 38.2% Fibonacci Retracement of its November 2015 – May 2016 dip, near 0.9780, are adjacent resistances to look upon. However, pair’s further advances beyond 0.9780 might have little space, till 0.9820, before confronting with 0.9830 trend-line resistance. In case of the pair’s successful break above 0.9830, 50% Fibo level of 0.9885 and the broader TL of 0.9960 become important north-side numbers to observe.

EUR/CHF

Considering EURCHF’s recent failure to break symmetrical triangle, the 1.0880 – 1.0910 range seems holding for the time being with downside more expected. If the pair breaks 1.0880 support, 1.0865 and the 1.0855 are expected following supports before it could test descending trend-line mark of 1.0840, which if broken opens the door for its southward trajectory towards 1.0825 and the July lows of 1.0790. Meanwhile, pair’s clear break above 1.0910 can trigger its uptick to 1.0925 and the 1.0960 resistance marks. Should the pair maintains its strength beyond 1.0960, the 1.0980 might act as intermediate halt before it could witness the 1.1000 psychological magnet.

GBP/CHF

While a month-old descending trend-line restricts the GBPCHF upside, the pair seems now declining to 1.2550 & 1.2530 before resting at the 1.2500 horizontal-region, which if broken drags the pair to August lows of 1.2450. Given the pair keep extending its south-run below 1.2450, it becomes vulnerable to test 1.2350 and the January lows of 1.1865. Alternatively, 1.2670 TL mark can keep confining the pair’s near-term upside, breaking which 1.2720 and the 1.2750 can come up soon. If the pair surpass 1.2750 resistance, 1.2785 and 1.2850 numbers can entertain the pair Bulls.

CAD/CHF

Even after breaking a month-old descending trend-line, the CADCHF failed to clear following TL mark of 0.7440 and is now indicating re-test to resistance-turned-support-line of 0.7380. In case if the pair dips below 0.7380, the 0.7350 and the 0.7335 might offer buffers before dragging the quote to 0.7300 round figure, also including early-week lows. However, the pair continues remaining strong till it trades above recent breakout and can surpass the 0.7440 resistance-line that favors its upside to 0.7455-60 horizontal resistance. Should the pair breaks 0.7460, 61.8% Fibonacci Retracement level of 0.7490 and the 0.7515 are expected north-side figures to please those to favor pair’s upside.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement