Advertisement

Advertisement

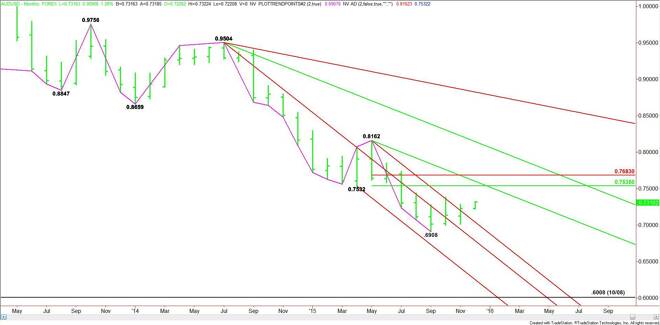

AUD/USD Monthly Technical Analysis for December 2015

By:

The AUD/USD continued to confound bearish traders in November with its lack of follow-through to the downside and its higher close. Last month, the Forex

The AUD/USD continued to confound bearish traders in November with its lack of follow-through to the downside and its higher close. Last month, the Forex pair finished higher while posting an inside move. This indicates impending volatility.

Short-sellers piled into the market in anticipation of a test of the recent bottom at .6908, but they were unable to drive the Forex pair lower. Expectations of a Fed rate hike in December and a huge drop in commodity markets, especially metals, had many investors thinking the Aussie would break sharply. Instead, the AUD/USD rallied after the Reserve Bank of Australia lifted the threat of an interest rate cut.

Based on the close at .7225, the direction of the market in December is likely to be determined by trader reaction to the downtrending angle at .7042.

A sustained move over .7042 will indicate the presence of buyers. This could create enough upside momentum to challenge the 50% level at .7535. This is followed closely by a downtrending angle at .7602 and a Fibonacci level at .7683.

A sustained move under .7042 will signal the presence of sellers. This will likely signal that the aggressive counter-trend buying and short-covering is over. If the selling pressure is strong enough then look for the selling to possibly drive the AUD/USD into the next downside target at .6784.

Watch the price action and read the order flow at .7042 this month. This will tell us whether the bulls or the bears are in control. Watch for volatility on December 16, following the release of the Fed’s monetary policy statement. The Fed is widely expected to announce a rate hike. Traders will also be watching the statement for further guidance as to the timing of the next rate hike.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement