Advertisement

Advertisement

Important JPY Pairs: Technical Overview

By:

USD/JPY With the recent risk-on market sentiment, backed by concerns of BoJ’s another monetary easing action, propelled the USDJPY to surpass 50-day SMA

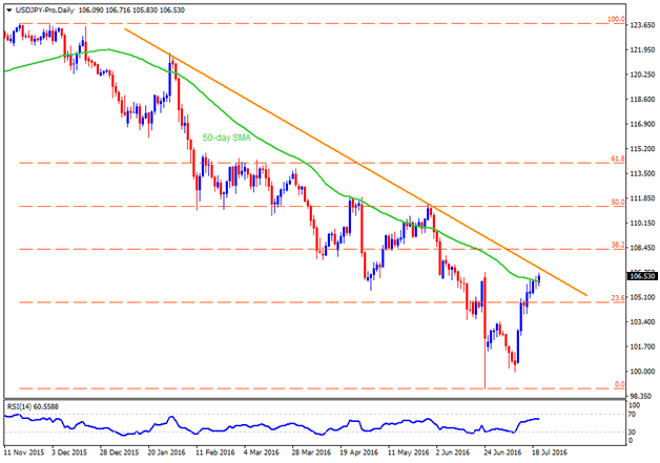

USD/JPY

With the recent risk-on market sentiment, backed by concerns of BoJ’s another monetary easing action, propelled the USDJPY to surpass 50-day SMA for the first time since June start; however, a six-month old descending trend-line resistance, at 107.20 now, still becomes an important resistance for the pair to clear before printing 107.55-60 on the chart. Should the pair successfully trades above 107.60, 38.2% Fibonacci Retracement of November 2015 – June 2016 downside, near 108.30, and the 109.00 round figure are likely crucial numbers that it needs to pass through in order to revisit 110.50 resistance mark. If the macro-economic uncertainty and the BoJ’s tendency to keep avoiding further measures drag the pair below 105.60-50 immediate support, it can drop to 23.6% Fibo level of 104.70 and then to 104.00 rest-point. Further, pair’s additional downside below 104.00 can have 103.30 and the 102.30 supports to cherish the pair bears, clearing which chances of its south-run to 101.40-30 can’t be denied.

EUR/JPY

Ever since the EURJPY cleared 116.30-40 horizontal area, it failed to clear a downward slanting trend-line resistance stretched since late-May. The pair presently confronts the same TL level around 117.60 which if broken can trigger its upside to 61.8% Fibonacci Retracement of May – June plunge, near 118.50. During the pair’s extended rise beyond 118.50, it can show 119.50 and the 120.00 round figure quotes ahead of marking 120.80 and the 121.30 resistances live. Alternatively, 50% Fibo level of 116.75 and the 116.40-30 can continue limiting its nearby downside, dipping below that can quickly mark 115.00 support, including 38.2% Fibo, and the 114.45-50 on the face of pair prices. Should the pair keep declining below 114.45, it becomes weaker enough to flash 113.20-25 and the 112.60 support levels.

GBPJPY

Following the GBPJPY’s failure to surpass 143.40-50 resistance-zone, the pair dipped to a week’s low; though, immediate ascending trend-line support of 138.50 confined its further downside and is presently fueling the pair towards 141.00 resistance mark. Given the pair manage to clear the 141.00, the 141.60 and the 142.40 might entertain its intermediate up-moves ahead of revisiting the 143.40-50 region. If the pair successfully surpasses the 143.50 resistance, the 144.00 and the 145.30 are likely consecutive upside numbers to observe. On the downside, a dip below 138.50 can drag the pair to 137.30 and the 135.80 support levels, which if broken can recall 134.10 – 134.00 and the 133.00 southward figures.

CADJPY

Since late-last-week, the CADJPY have been trying to break a three-month old descending trend-line, at 81.70 now, but keep disappointing the pair bulls. Looking at the downward slopping RSI, chances are higher that the pair might revisit its 80.80 immediate support soon. If the pair declines below 80.80, the 23.6% Fibonacci Retracement of its November 2015 – June 2016 south-run, at 80.00 psychological magnet, becomes important, which if broken can reprint 78.75-65 on the chart. Meanwhile, pair’s upside clearance of 81.70 still needs to surpass 50-day SMA level of 82.00 in order to visit 38.2% Fibo level of 82.60 and the 83.00 resistance marks. Given the pair maintains its upward trajectory beyond 83.00, the 83.80 and the 50% Fibo level of 84.60-65 bear more probabilities to comeback.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement