Advertisement

Advertisement

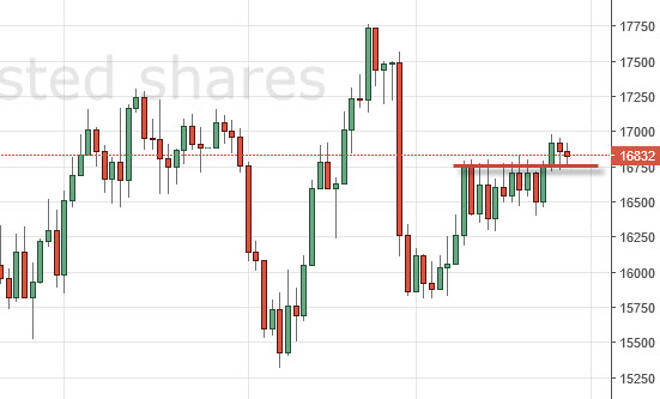

Nikkei Forecast May 30, 2016, Technical Analysis

Updated: May 30, 2016, 06:37 GMT+00:00

The Nikkei initially went back and forth during the course of the session on Friday, as we ended up forming a bit of a neutral candle, so that suggests

The Nikkei initially went back and forth during the course of the session on Friday, as we ended up forming a bit of a neutral candle, so that suggests that the market is trying to figure out what to do from this point in time. The ¥16,750 level is supportive, as it has previously been resistive. In fact, breaking above the top of that level was a very significant milestone, and the fact that we pulled back and found buyers in that area suggests that the buyers are starting to get a little bit more aggressive.

If we can break above the top of the range during the session on Friday, the market should continue to go higher, but it might be a bit of a grind, not necessarily an explosive move higher. Ultimately, the market should then reach towards the ¥17,750 level, and of course as a result we are “buy only.”

Be aware the fact that the Bank of Japan is still likely to do quite a bit of movements in order to try to bring down the value the yen, which of course has quite a bit of influence on what happens with the Nikkei 225, as there are so many companies on this index that quite a bit business via exports, so that should continue to be a very important correlation, as a lower value yen keeps these exports cheaper for other countries around the world. Of particular interest is the USD/JPY pair, as the Americans by so many Japanese products.

Recently, we have had higher lows, and as a result it looks like the market will try to go higher but this pair typically is quite a bit of choppiness before we finally get some type of move higher that is a little bit more sustainable. Pullbacks will continue to offer value, and as a result I believe that it’s only a matter of time before we continue to see buyers jump into this marketplace, and as a result I feel that it is almost just a matter of time.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement