Advertisement

Advertisement

Technical Plays of EURGBP, GBPJPY & EURJPY

By:

EUR/GBP Having failed to sustain the 0.8600 break, the EURGBP ended-up witnessing a pullback during mid-July; however, the pair took a U-turn from 61.8%

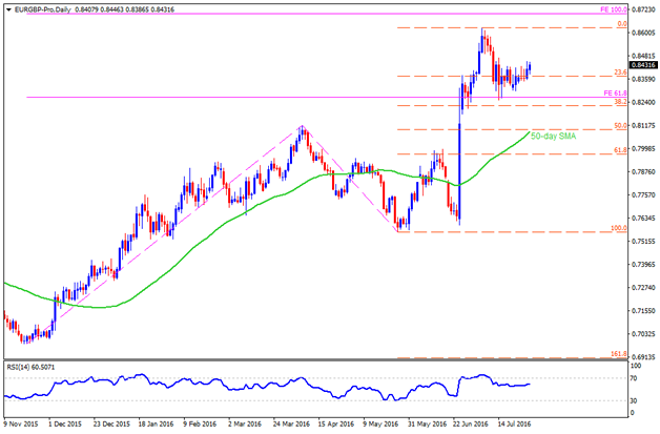

EUR/GBP

Having failed to sustain the 0.8600 break, the EURGBP ended-up witnessing a pullback during mid-July; however, the pair took a U-turn from 61.8% FE of its November 2015 – April 2016 upside and is presently confronting with 0.8450 immediate resistance, breaking which 0.8485-90 and the 0.8550 are likely upside numbers that it has to confront prior to challenging the previous highs of 0.8627. Given the pair manage to clear 0.8630, 100% FE level at 0.8700 round figure becomes a tough mark for it to surpass, which if broken enables it to visit 2013 highs around 0.8820. On the downside, 0.8340, 0.8300 and the 61.8% FE level of 0.8260, are likely nearby supports that could confine the pair’s downturn. Should the pair drops below 0.8260, 38.2% Fibonacci Retracement of its May – July upside, at 0.8220, might act as intermediate halt, clearing which 0.8095-90 support-confluence, comprising 50-day SMA & 50% Fibo level, becomes an important area for the pair traders to watch.

GBP/JPY

GBPJPY’s immediate downtrend, as portrayed by short-term descending trend-channel, signals the pair’s readiness to test the 134.15-10 support-line. Though, further breaks below 134.10, also clearing 134.00, might be restricted by oversold RSI and can trigger the pair’s bounce to 137.50 and the channel resistance-line of 139.00. If the pair successfully breaks above 139.00, the 140.10 and the 141.40 might please intermediate Bulls ahead of confronting 143.20-30 horizontal resistance. Alternatively, pair’s excessive decline below 134.00 can drag the prices to 133.20 and the 131.90, breaking which 130.70 & 129.50 are likely following downside numbers to observe. If at all the pair refrains from stopping its south-run around 129.50, it becomes vulnerable enough to plunge towards 61.8% FE of June – July plunge, at 123.65.

EUR/JPY

Alike GBPJPY, the EURJPY also bears the burden of BoJ’s disappointment and indicates additional downside towards 113.70 immediate trend-channel support. Should the pair declines below 113.70, the 23.6% Fibonacci Retracement of its May – June drop, near 112.80, and the 112.50 might hold its additional dips. If the JPY strength drags pair prices below 112.50, chances of its drop to 110.80 and then to June month lows of 109.30 can’t be denied. Meanwhile, pair’s reversal from the current prices needs to break above 115.80 resistance before targeting the 116.75-85 resistance region, including 50% Fibo and the channel’s upper-line. However, pair’s additional run-up beyond 116.85 might find it difficult to surpass two-month old trend-line resistance of 117.50, which if broken can trigger its upward trajectory towards 61.8% Fibo level of 118.50 and to 119.00 round figure resistance.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement