Advertisement

Advertisement

USD/CHF, EUR/CHF, GBP/CHF And AUD/CHF: Technical Check

By:

USD/CHF Even as the USDCHF dropped below eleven month old ascending trend-channel support during early week, a close below four month old downward

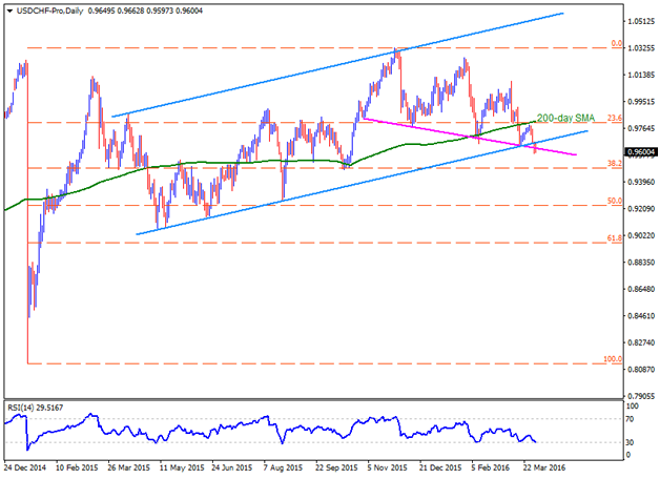

USD/CHF

Even as the USDCHF dropped below eleven month old ascending trend-channel support during early week, a close below four month old downward slanting trend-line, presently at 0.9615, becomes necessary for the pair to aim for 38.2% Fibonacci Retracement of its January – November 2015 upside, at 0.9480. Should the pair continue on its downside below 0.9480, the 0.9400 might act as an intermediate support before it could drop to August 2015 lows around 0.9260 mark. Alternatively, a daily close above 0.9615 can continue witnessing the channel support, now resistance, at 0.9660, as immediate cap, breaking which 0.9750 is likely a buffer level prior to visiting 0.9810-15 area, comprising 23.6% Fibo and 200-day SMA. If at all the pair manages to surpass 0.9815 on a closing basis, it can quickly rise to 0.9900 and then to the 0.9980-85 before challenging the 1.0100 region.

Although the EURCHF managed to test two week high, 38.2% Fibonacci Retracement of its February downside, at 1.0960, quickly followed by the resistance-line of a “symmetrical triangle” formation, near 1.0980, might hold the pair’s further advances captive. If the pair neglects the triangle resistance, it can quickly move-up to present month highs of 1.1020 before rallying to 1.1060 and then to 1.1100. Additionally, pair’s sustained trading above 1.1100 enables it to challenge the February highs of 1.1200. On the downside, 1.0920 and the 23.6% Fibo, at 1.0900 round figure mark, adjacent to the pattern lower-line of 1.0890, are likely nearby supports that the pair traders should look at, which if broken can drag the pair towards 1.0860 and the February lows of 1.0810. Given the pair’s extended south-run below 1.0810, also clearing 1.0800, it can witness 1.0750 and the 1.0700 support levels.

GBP/CHF

GBPCHF’s bounce from 1.3730-25 horizontal support, forming part of ‘descending triangle’, failed to surpass the pattern resistance, at 1.3920 now, dragging the pair currently towards 1.3780 support. However, pair’s further decline below 1.3780 might find it difficult to break the 1.3730-25 support-zone, clearing which can further fetch the pair prices to 61.8% FE of its February decline, near 1.3650-45. Moreover, pair’s additional weakness below 1.3645 can trigger its plunge to 1.3450. Meanwhile, a clear break above 1.3920 might propel its rise to 1.4060 and to the 1.4140 resistance levels while further upside above 1.4140 opens the door for its northward trajectory to 1.4200 and the 1.4280 resistances.

AUD/CHF

AUDCHF seems presently struggling with a short-term descending triangle resistance, around 0.7400 – 0.7410, which if broken can trigger the pair’s rally to 0.7460; though, the 0.7550-60 area, including the current month high, might hinder its further rise. If the pair manages to clear the 0.7560, it can quickly advance to April 2015 highs around 0.7670-75. Should the pair reverses from current levels, the 23.6% Fibonacci Retracement of its February – March up-move, at 0.7360, acts as immediate support for the pair, breaking which it can revisit the 0.7300 – 0.7295 horizontal support-line, forming part of the triangle. Given the pair’s drop below 0.7295, the 0.7240, 0.7190 and the 0.7130 are likely consecutive supports that it may witness during sustained decline.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement