Advertisement

Advertisement

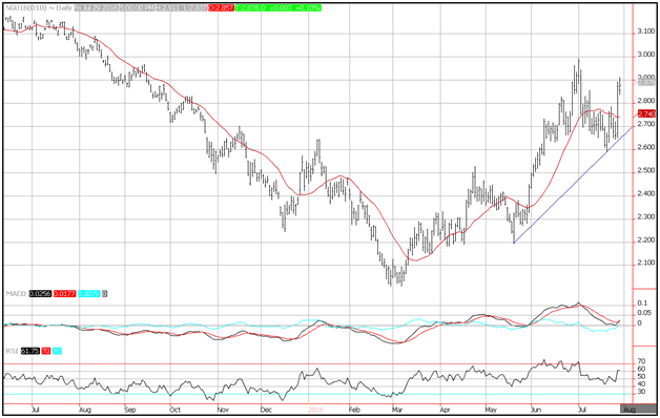

Technical Analysis Natural Gas For August 1, 2016

By:

Natural gas prices rallied for a second straight day following a report from the Energy Information Administration that showed a smaller than expected

Natural gas prices rallied for a second straight day following a report from the Energy Information Administration that showed a smaller than expected build in natural gas inventories. Warmer than normal weather is generating unusual cooling demand driving up natural gas prices. Resistance is seen near the July highs near 3 per mmbtu, while support is seen near the 20-day moving average at 2.74. Momentum has turned positive as the MACD (moving average convergence divergence) index generated a buy signal.

[wibbitz]bdc1224d05a37470db7b454bbf8668fca[/wibbitz]

According to the EIA, working gas in storage was 3,294 Bcf as of Friday, July 22, 2016. This represents a net increase of 17 Bcf from the previous week, which compares to the 35 Bcf increase expected. Stocks were 436 Bcf higher than last year at this time and 524 Bcf above the five-year average of 2,770 Bcf. At 3,294 Bcf, total working gas is above the five-year historical range.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement