Advertisement

Advertisement

A Quiet Economic Calendar Leaves Geopolitics and COVID-19 in Focus

By:

A quiet day on the economic calendar leaves Brexit news and chatter from Trump and Capitol Hill in focus.

Earlier in the Day:

It’s was a relatively busy start to the day on the economic calendar this morning. The Japanese Yen and Aussie Dollar were in action, with economic data from China also in focus.

Away from the economic calendar, chatter from the U.S also provided direction in the early part of the Asian session. Hopes of further U.S COVID-19 relief stimulus drove demand for riskier assets early in the day. The risk-on sentiment led to an early pullback in the Greenback.

For the Japanese Yen

Household spending figures were in focus. In August, spending rose by 1.7%, month-on-month, falling short of a forecasted 3.2% rise. In July, spending had slumped by 6.5%.

Year-on-year, spending slid by 6.9%, following a 7.6% tumble in July. Economists had also forecast a 6.9% fall.

According to the Statistic Bureau,

- Spending on culture & recreation (-23.4%) and clothing & footwear (20.2%) weighed heavily on the headline figure.

- There were also marked declines in spending on transportation & communication (-12.5%) and food (-3.9%).

- By contrast, there were marked increases in spending on medical care (+11.7%), furniture & household utensils (+8.1%), and fuel, light, & water charges (+6.2%).

- Spending on housing rose by a modest 1.1%, year-on-year.

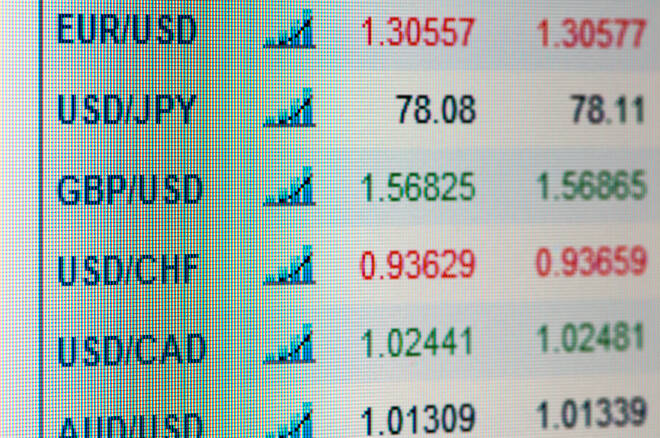

The Japanese Yen moved from ¥106.024 to ¥106.018 upon release of the figures. At the time of writing, the Japanese Yen was up by 0.16% ¥105.86 against the U.S Dollar

For the Aussie Dollar

The RBA released its financial stability review early this morning. Highlights from the review included:

- Households’ finances in Australia have been cushioned from the impact of the pandemic by support measures. Despite a sharp decline in output and falling employment, overall household income increased with large fiscal stimulus payments. Households have greatly increased their saving.

- Most businesses started with low debt going into the crisis. Support measures helped maintain cash flow despite the sharp reduction in revenue.

- The strong Australian financial system can support economic recovery. Banks have high capital levels and most of their loans are well-secured.

The Aussie Dollar moved from $0.71689 to $0.71699 upon release of the review that preceded China’s services PMI.

Out of China

The service sector was in focus this morning. September’s Caixin Service PMI rose from 54.0 to 54.8. Economists had forecast a fall to 53.0.

According to the September survey,

- Growth was supported by a marked increase in total new business, though new export work continued to decline.

- Firms expanded payrolls for the 2nd consecutive month amid increased capacity pressures.

- Prices charged by service companies rose for the 2nd month in a row. There were some reports of tough market competition, however, that limited overall pricing power.

- Service providers recorded a much softer rise in operating expenses at the end of the quarter. The rate of inflation dipped to a 3-month low and was only marginal.

- Business confidence remained strongly positive. The degree of positive sentiment was firmer than in August and broadly in line with the historical average.

The Aussie Dollar moved from $0.71771 to $0.71817 upon release of the figures. At the time of writing, the Aussie Dollar was up by 0.22% to $0.7181.

Elsewhere

At the time of writing, the Kiwi Dollar was up by 0.41% to $0.6604.

The Day Ahead:

For the EUR

It’s a particularly quiet day ahead on the economic calendar. There are no material stats due out of the Eurozone to provide the EUR with direction.

A lack of stats will leave the EUR in the hands of geopolitics and market risk sentiment. U.S Presidential Election campaign chatter, updates from Capitol Hill, and Brexit will likely be the key drivers on the day.

At the time of writing, the EUR was up by 0.14% to $1.1775.

For the Pound

It’s a particularly busy day ahead on the economic calendar. Key stats include August GDP and manufacturing production figures. Industrial production and trade data, also due out, will likely have a muted impact on the Pound.

Away from the economic calendar, however, expect Brexit to continue to be a key driver.

At the time of writing, the Pound was up by 0.13% to $1.2955.

Across the Pond

It’s a particularly quiet day ahead for the U.S Dollar. There are no material stats to provide the Dollar with direction.

A lack of stats will leave the focus on COVID-19 stimulus updates and U.S Presidential Election news.

The Dollar Spot Index was down by 0.13% to 93.482 at the time of writing.

For the Loonie

It’s a relatively busy day ahead. September employment figures are due out later today. Expect the numbers to influence.

At the time of writing, the Loonie was up by 0.08% to C$1.3186 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement