BNB Price Forecast: Can Binance Coin Hold Above $1K After Bearish Divergence?

BNB is cooling after record highs above $1,050, with bearish signals pointing to a potential pullback. Key EMA levels and whale accumulation will decide whether the dip holds or deepens.Binance’s BNB (BNB) token has started to cool off days after notching record highs above $1,050.

The move comes amid a broader crypto market correction, driven by de-risking sentiment as the US dollar recovers. BNB, though, has suffered one of the largest losses in the last 24 hours, down over 5.25%, with a bearish divergence signal appearing to have boosted selloffs.

Can the BNB price drop further due to unsupportive fundamentals and technical issues? Let’s examine.

BNB Bearish Divergence Clouds Upside Momentum

On the daily chart, BNB’s price rally has formed higher highs while the RSI has printed lower highs. This divergence typically hints at weakening upside momentum, increasing the probability of a near-term pullback.

Historically, similar divergences in June and December 2024 preceded sharp corrections in the 20%–37% range. While no two setups are identical, the current overstretched rally resembles those previous episodes.

The immediate downside target sits at the 20-day EMA (green wave), near $947. A correction to this level would represent a modest 7% drop from current prices and align with previous healthy retests during uptrends.

Deeper corrections could extend toward the 50-day EMA (red wave), now near $882, coinciding with the 0.236 Fibonacci retracement level at $928.

A break below this confluence zone would open the door to a test of the 200-day EMA (blue wave) near $747, a steeper 25% drawdown.

BNB’s past corrections have found footing around these EMA bands before resuming their broader uptrend. Therefore, these levels remain critical gauges of market sentiment.

What Could Change This View?

BNB’s broader trend remains bullish, still trading comfortably above its 20-, 50-, and 200-day EMAs, and volume trends suggesting healthy participation during rallies.

If bulls defend the 20-day EMA, BNB could quickly resume its upside toward $1,100 and beyond, especially if Bitcoin steadies after its recent correction.

BNB looks poised for a cooldown, with the $947–$882 range as the first downside cushion. A breach below could drag the token toward $747, but the path of least resistance remains upward as long as EMA support levels hold.

BNB’s On-Chain Signals Supportive of Dips

Onchain data paint a more nuanced picture for BNB.

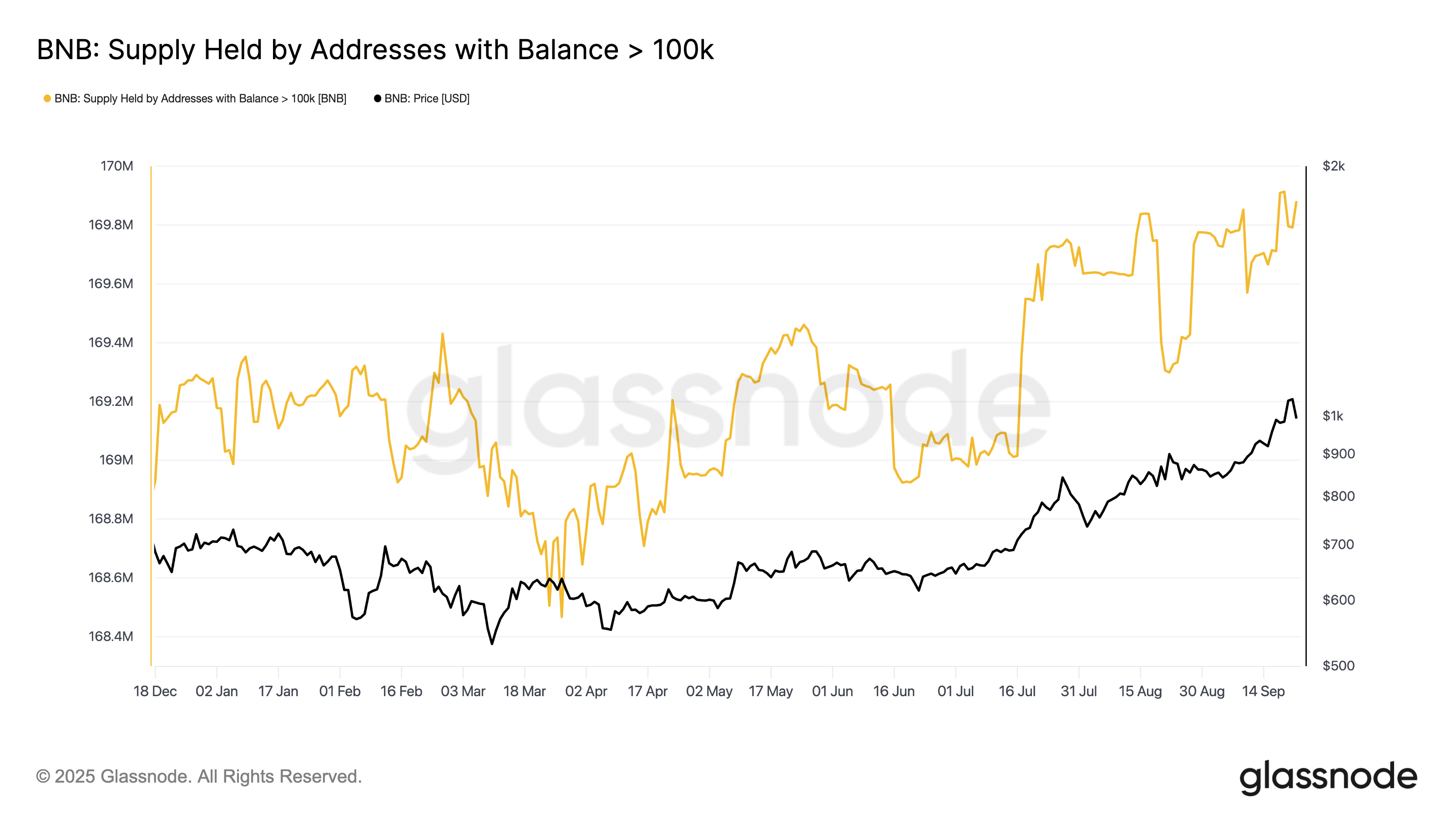

Glassnode data shows that BNB whales holding over 100,000 tokens have been quietly adding to their balances recently, pushing total holdings to fresh highs.

Such accumulation suggests that the most prominent players are positioning for long-term strength, even as prices hover near record territory.

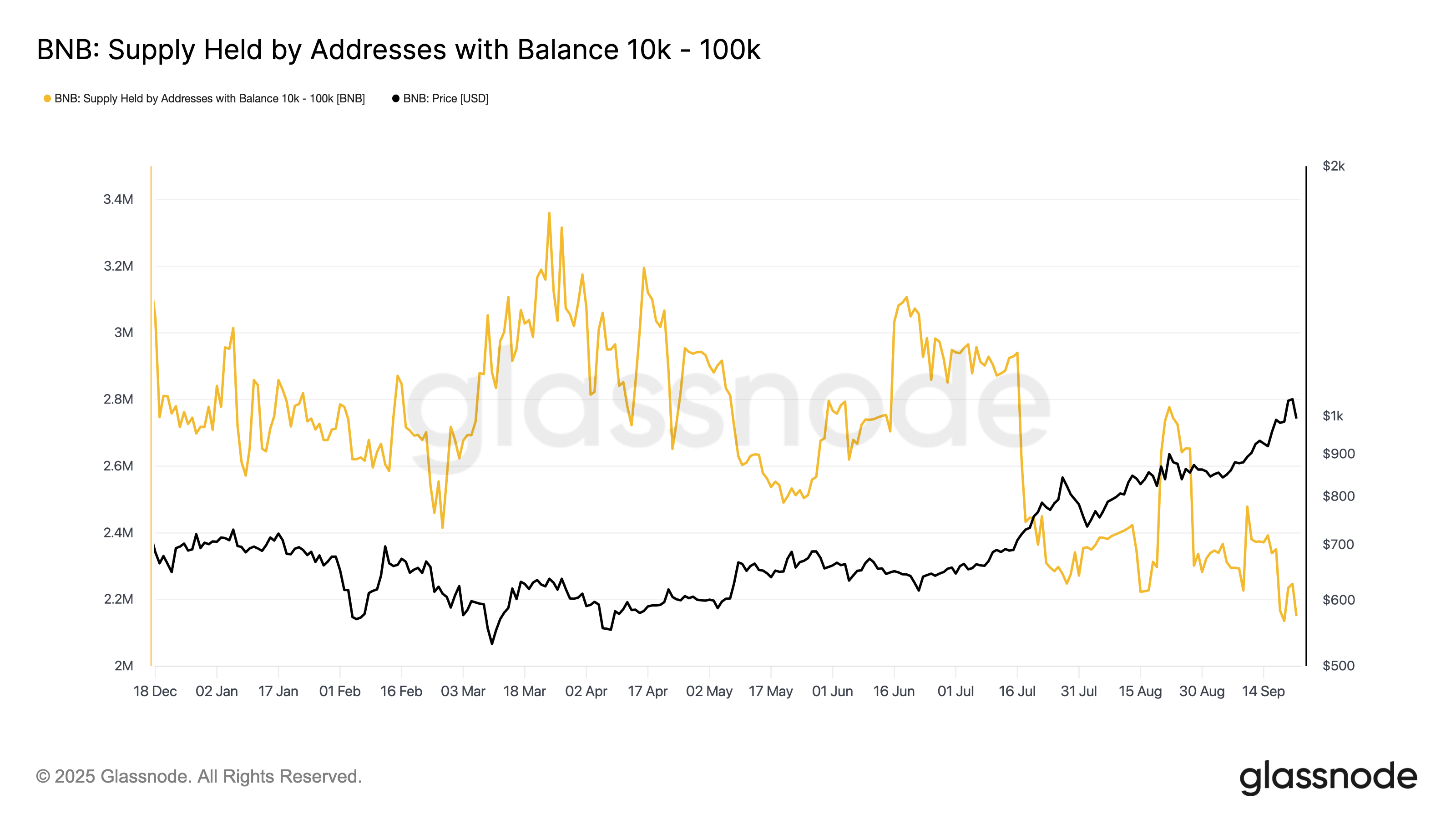

By contrast, mid-sized holders (10k–100k BNB) have been the primary distributors, trimming positions and likely booking profits after BNB’s breakout above $1,000.

The split signals that while short-term corrections are probable, strong demand from whales and smaller accumulators could soften the downside and limit the depth of any sell-off.