Advertisement

Advertisement

Market Participants Pay Attention to the Upcoming Fed Meeting and Ukraine

By:

The overwhelming consensus is that the Federal Reserve will tighten its monetary policy with a series of rate hikes over the next two years.

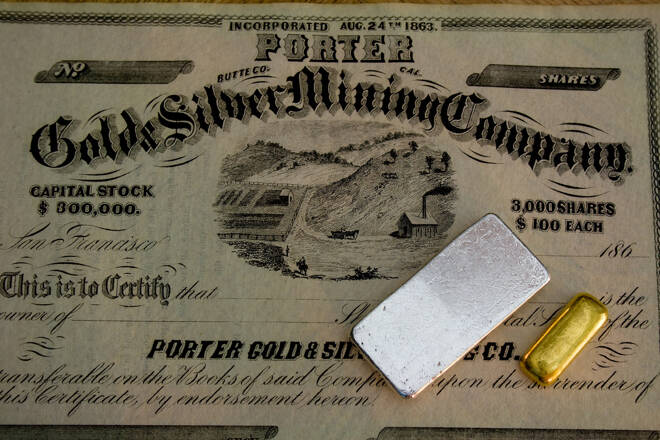

Gold had moderate gains today as market participants await the policy decisions that will be revealed on Wednesday when the Federal Reserve concludes its FOMC meeting, releases its most current policy statement and holds a press conference with Chairman Powell. Also, on the minds of the investment community are the geopolitical uncertainties as tensions grow regarding a buildup of Russian troops on their border with Ukraine.

As of 4:05 PM EST gold futures basis, the most active April 2022 Comex contract is fixed at $1842.70, after factoring in today’s net gain of $11 or 0.60%. The Federal Reserve has already begun the process of tapering their asset purchases which were at $120 billion per month. At their current pace, they will complete this process by March of this year, at which time the Fed will no longer be purchasing any new assets. However, once complete, the asset balance sheet will have ballooned to approximately $8.9 trillion. It is anticipated that the Federal Reserve will reduce its asset balance sheet at some point towards the end of this year.

The overwhelming consensus is that the Federal Reserve will tighten its monetary policy with a series of rate hikes over the next two years. Currently factored into market sentiment is the high probability of three to four ¼% rate hikes in 2022, which will be followed by an additional three rate hikes of ¼% in 2023.

Reuters polled 86 economists earlier this month, and the results indicate that a strong minority (40 out of 86) believe that the Fed will implement at least four ¼% rate hikes this year. The poll also revealed that 37 out of 51 economists believe that the central bank will start reducing its enormous balance sheet by the end of the third quarter.

Russia – Ukraine geopolitical tensions grow

It is widely believed that market participants for the most part have already largely factored in the updated more hawkish monetary policy that will be announced by the Federal Reserve on Wednesday. That being said, today’s gains in gold were largely due to the rising tensions between Russia and Ukraine.

Russia continues to build up its military presence on its border with Ukraine. This has created genuine concern throughout Western Europe and the United States. Western Europe has put NATO allies on standby, and the United States announced today that it is putting 8500 troops on alert as well. This increased geopolitical tension has created bullish undercurrents for gold pricing.

Our technical studies indicate that current resistance for the most active April contract of gold first occurs at $1848, the intraday high that occurred on Thursday, January 20, to $1851, the 23.6% Fibonacci retracement created from a data set that begins on November 3, 2021, when gold was trading at $1750 up to the high of November 16 at $1879.60. Our studies also indicate that support for gold occurs at $1826, which is the 61.8% Fibonacci retracement of a much longer data set which begins on June 1, 2021, when gold reached $1920, down to the lows that occurred during the first week of August when gold traded to $1678.

Wishing you as always good trading and good health,

For those who would like more information simply use this link.

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement