Advertisement

Advertisement

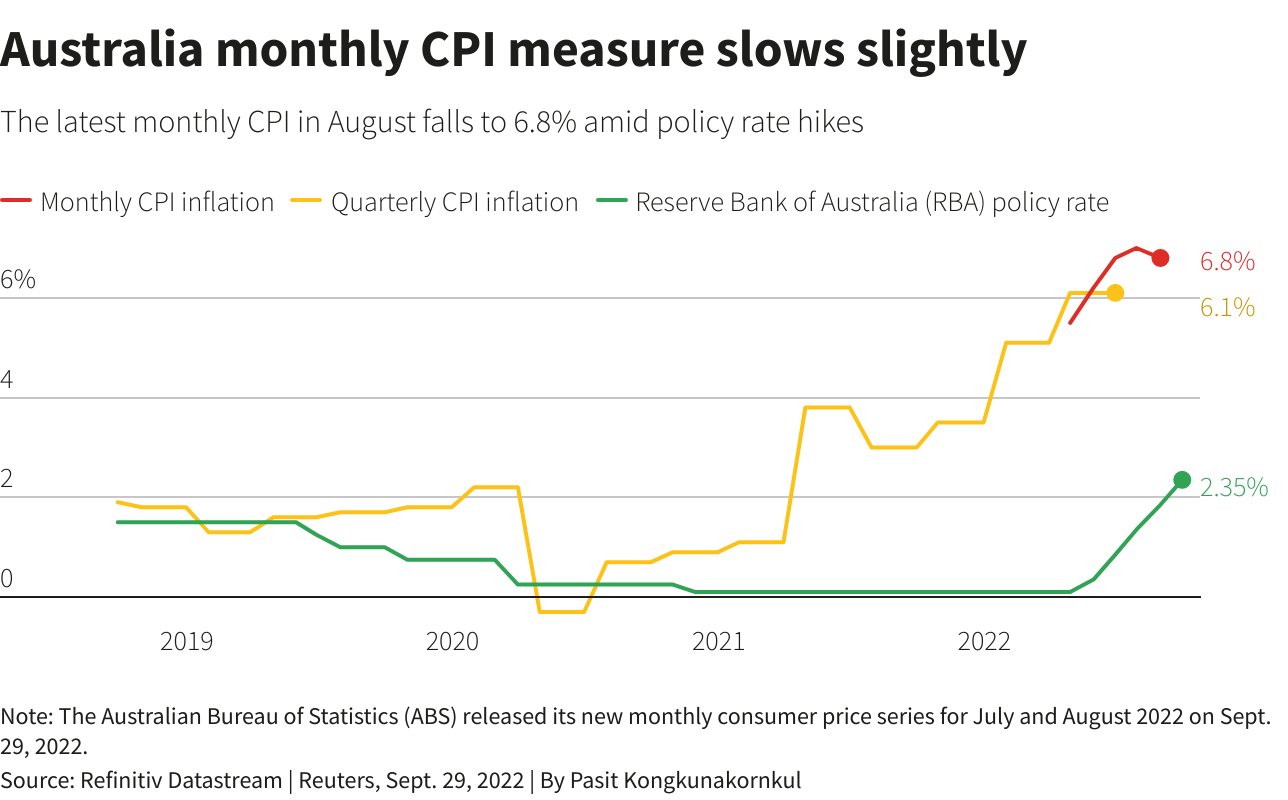

Australia monthly CPI measure slows slightly to 6.8% y/y in August

By:

SYDNEY (Reuters) - A new monthly measure of Australian consumer prices on Thursday showed annual inflation eased slightly in August from July thanks to a steep drop in petrol prices, offering hope cost of living pressures might be close to a peak.

By Wayne Cole

SYDNEY (Reuters) – A new monthly measure of Australian consumer prices on Thursday showed annual inflation eased slightly in August from July thanks to a steep drop in petrol prices, offering hope cost of living pressures might be close to a peak.

The data come before the Reserve Bank of Australia’s (RBA) policy Board meeting next week, where markets are wagering it will hike interest rates by 50 basis points to a nine-year high of 2.85%.

The Australian Bureau of Statistics (ABS) reported its monthly indicator of consumer prices (CPI) rose 6.8% in August from a year earlier. That was down from 7.0% in July and a return to June’s 6.8% level.

Still, it was higher than the standard quarterly CPI release which showed inflation running at 6.1% in the June quarter, implying the September quarter would likely show a pick up.

The monthly readings can differ sharply from quarterly figures which average CPI over the three months.

“The slight fall in the annual inflation rate from July to August was mainly due to a decrease in prices for automotive fuel,” said David Gruen, the Australian Statistician. “This saw the annual movement for automotive fuel fall from 43.3% in June to 15.0% in August.”

In contrast, annual inflation for fruit and vegetables more than doubled to 18.6% in August as flooding hit the farm sector.

Utility prices have also been rising but are only included in the quarterly CPI release.

This is only the second release of the monthly CPI indicator, with the September data due in late October and then at roughly four-week intervals.

The monthly CPI only has around two thirds of the price observations of the quarterly series and is more volatile, somewhat limiting its usefulness.

It is also not yet seasonally adjusted and does not include measures of core inflation favoured by the RBA.

Asked about the new indicator recently, RBA Deputy Governor Michele Bullock said it would contain a lot of statistical noise and was unlikely to affect the Board’s policy decision at the October meeting.

A spike in inflation this year has led the central bank to lift rates by a steep 225 basis points, and markets are pricing in further moves toward 4.35%.

(Reporting by Wayne Cole; Editing by Jacqueline Wong and Jamie Freed)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement