Advertisement

Advertisement

Barclays warns of sub-parity euro, 5 ppt GDP hit if Russia turns off gas taps

By:

LONDON (Reuters) - Analysts at Barclays have warned of a 5 percentage point hit to euro zone GDP and dive below dollar parity for the euro if Russia closes its gas taps as part the escalating war in Ukraine.

By Marc Jones

LONDON (Reuters) – Analysts at Barclays have warned of a 5 percentage point hit to euro zone GDP and a dive below dollar parity for the euro if Russia closes its gas taps as part of the escalating war in Ukraine.

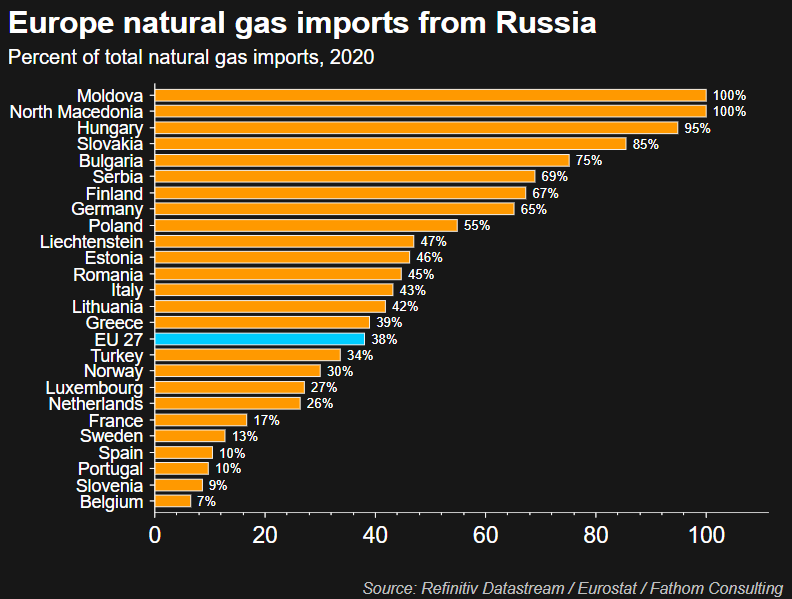

Worries are mounting in Europe that Moscow could sharply reduce the amount of gas it supplies or even stop it altogether as tensions rise and sanctions intensify over its assault on Ukraine.

The Kremlin has already cut off supplies to Bulgaria and Poland and this week sanctioned Gazprom’s European subsidiaries including Gazprom Germania, prompting Germany’s Economy Minister Robert Habeck to warn of no more gas from Russia.

“If Russia closes its gas taps (to Europe), we expect EURUSD to fall below parity,” Barclays said in a note on the rising tensions.

The euro is now at $1.03, having slumped around 8% in the last three months.

“Our economists estimate that a total loss of Russian supplies, combined with rationing of the remainder, could dent euro area GDP by more than 5 percentage points over one year”.

Pressure is now on Europe to secure alternative gas supplies well before the winter sees temperatures drop again.

The EU is currently grappling with Russia’s demand that countries start paying for their gas in roubles rather than euros or dollars as they traditionally have.

Bowing to such a demand could mean countries effectively breach their own sanctions brought against Russia as part of a co-ordinated move by the West to punish Moscow for its “special military operation” in Ukraine.

A recent report by credit ratings giant Moody’s warned that a halt to the energy trade between Russia and Europe would lead to recessions around the world

About 25% of the nearly 4,000 non-financial companies Moody’s analyses globally would “face significant stress” it said, although it would be a significantly higher 40% in the Europe Middle East and Africa (EMEA) region.

It “will cause significant stress around the world” Moody’s said.

(Reporting by Marc Jones; editing by Dhara Ranasinghe and Kim Coghill)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement