Advertisement

Advertisement

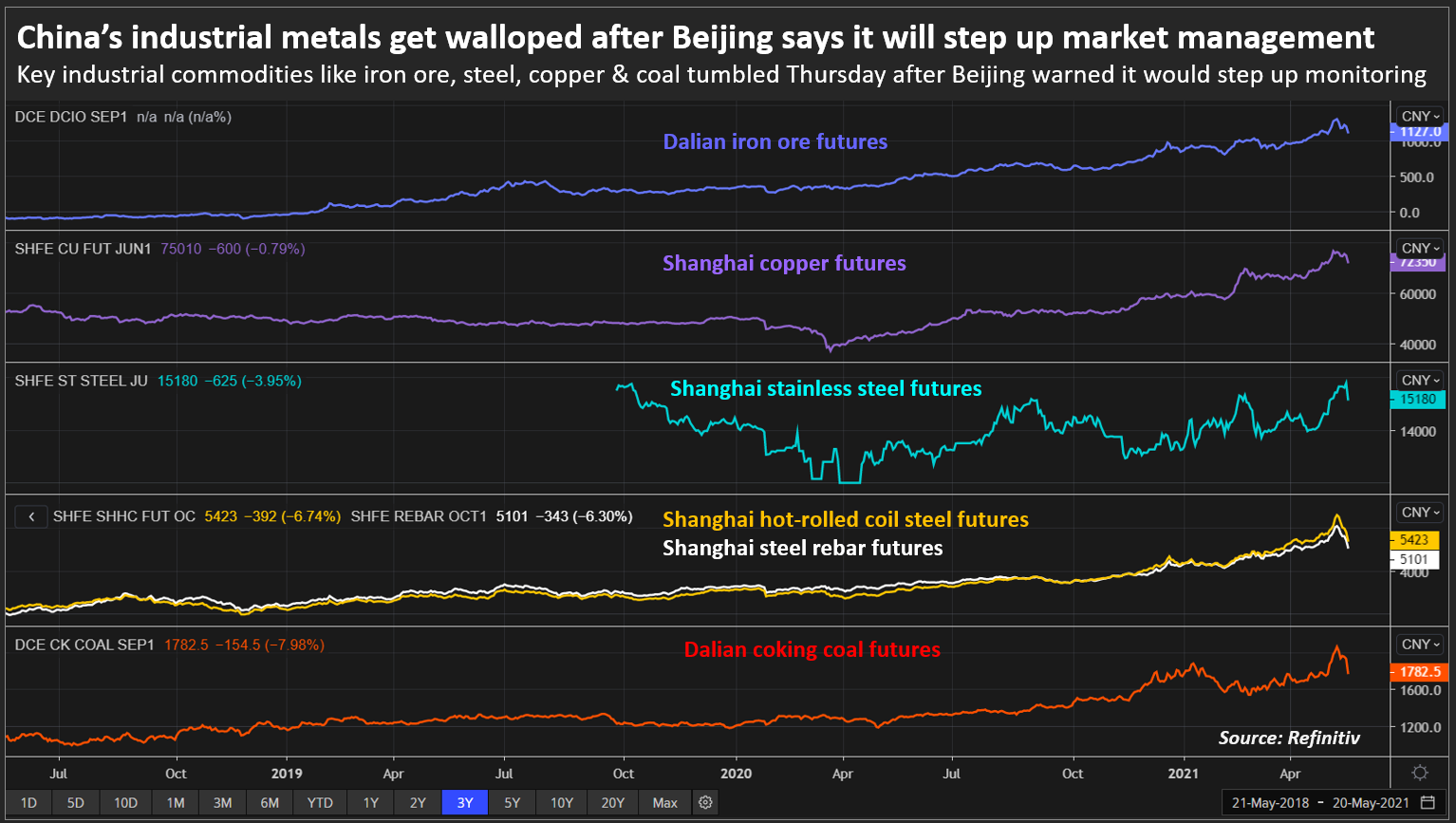

China’s Industrial Commodities Slide after Beijing Warns of Market Crackdown

By:

(Reuters) - China's main industrial commodities tumbled on Thursday after the government announced stepped-up measures to keep a lid on soaring raw material prices which threaten to undermine the country's economic recovery.

Prices of key steelmaking ingredients iron ore and coking coal, as well as steel products such as rebar and hot-rolled coil, all swooned more than 5% as traders offloaded supplies and speculators placed short-sided bets that Beijing’s measures will trigger a further pullback in metals markets.

China’s cabinet announced on Wednesday that it will strengthen management of commodity supply and demand to curb “unreasonable” prices and investigate behaviour that bids up commodity costs, spooking China’s hoards of metal traders.

Analysts at ANZ said Steel and iron ore prices remain supported by strong seasonal demand, record high steel production, attractive steel margins and subdued supply.

“China’s measures to curb steel production and exports were not much help in containing the price rise. Falling iron ore inventories reflect strong underlying fundamentals,” ANZ said.

PANDEMIC RECOVERY

Beijing’s warning about overheated markets follows a 30%-40% climb in several critical steel and metal prices so far in 2021, fuelled by a synchronised recovery in China’s mammoth construction and manufacturing sectors from last year’s pandemic.

The world’s largest exporter of finished and semi-finished goods gobbled up record amounts of metal since late 2020 to churn out appliances, exercise equipment, shipping containers and other goods that have seen strong demand globally in recent months.

However, the broad-based rally in industrial activity – which also propelled thermal coal prices to record highs this month as power use surged – is now threatening to strangle demand from consumers and ignite inflation.

China’s factory gate prices rose at their fastest pace in three and a half years last month, raising concerns that consumer prices will follow suit if commodity costs continue to climb.

Richard Lu, senior analyst at commodity consultant CRU Group’s Beijing office, said high steel prices “will frighten some consumers at some point.”

But he said steel margins “remain good on average”, which will encourage Chinese mills to continue operating intensively unless further restrictions are rolled out.

(Reporting by Gavin Maguire in Singapore; Editing by Lincoln Feast.)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement