Advertisement

Advertisement

Dollar slips as profit-taking, falling yields bite

By:

LONDON (Reuters) - The dollar steadied on Tuesday after posting its biggest drop in three weeks during the previous session as investors consolidated positions following a recent rally.

By Saqib Iqbal Ahmed and Saikat Chatterjee

NEW YORK (Reuters) – The U.S. dollar slipped to a two-week low against a basket of currencies on Tuesday, as traders booked profits after a strong March and as a fall in Treasury yields from recent peaks put pressure on the U.S. currency.

The U.S. Dollar Currency Index, which measures the greenback against a basket of six currencies, was 0.146% lower at 92.427, its lowest since March 24.

The dollar has risen this year, along with Treasury yields, as investors bet the United States would recover more quickly from the pandemic than other developed nations, amid massive stimulus and aggressive vaccinations. At 2.5%, the gain in March was the dollar’s biggest monthly increase since the end of 2016.

“I think we are seeing some profit taking to start the new quarter,” John Doyle, vice president of dealing and trading at FX payments firm Tempus Inc, said.

“Treasury yields have played a role in helping the dollar find its footing. Lower yields today would add fuel to the equity fire and diminish demand for the greenback too.”

U.S. Treasury yields fell on Tuesday, while U.S. stocks edged to a fresh high, further sapping demand for the safe-haven U.S. currency.

Against the Japanese yen, the dollar slipped 0.28% to 109.87 yen, a one-week low.

The International Monetary Fund raised its outlook for global economic growth again on Tuesday, forecasting worldwide output would rise 6% this year, reflecting a rapidly brightening outlook for the U.S. economy.

The upbeat assessment follows an encouraging U.S. jobs report on Friday and a solid U.S. services activity reading on Monday.

“The dollar is likely to find continued support from the notion that the world’s biggest economy appears to be in the early innings of a vaccine- and stimulus-fueled economic boom,” Joe Manimbo, senior market analyst at Western Union Business Solutions, said in a note.

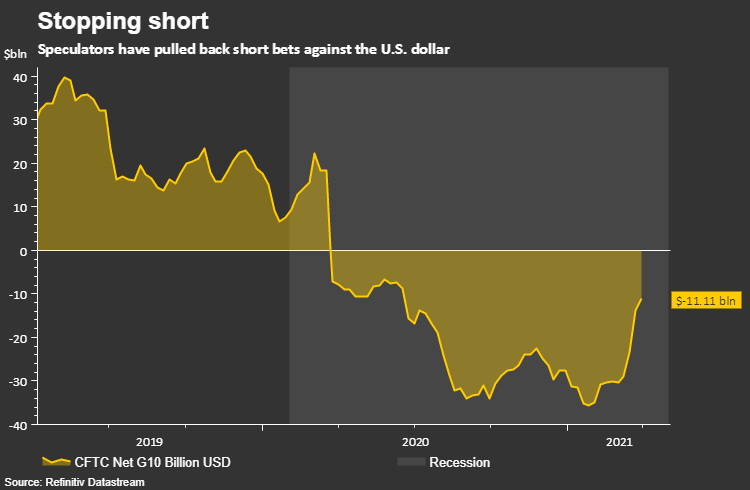

Speculators’ net bearish bets on the U.S. dollar fell in the latest week to the lowest since June 2020, calculations by Reuters and U.S. Commodity Futures Trading Commission data released on Friday showed.

Sterling slipped on Tuesday as investors withdrew some cash after cable jumped to its highest in more than two weeks, while traders continued to bet on a speedy re-opening of the British economy.

Major cryptocurrency Etheruem reached a peak of $2,151.63 on Tuesday, before giving up the day’s gains.

The rise of Ethereum, which like most smaller cryptocurrencies tends to move in tandem with bitcoin, has helped the cryptocurrency market capitalization reach a record $2 trillion on Monday, data and market trackers CoinGecko and Blockfolio showed.

(Reporting by Saqib Iqbal Ahmed and Saikat Chatterjee; additional reporting by Tom Wilson; editing by Larry King and Barbara Lewis)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement