Advertisement

Advertisement

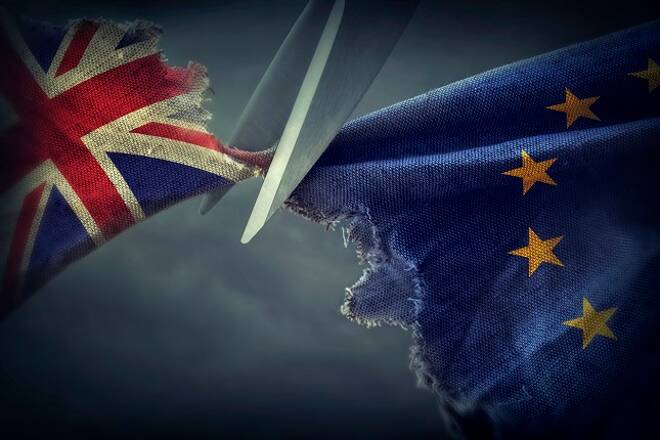

Forex Daily Recap – Cable Dropped as Odds for a Hard Brexit Increased with Farage’s Win

Published: May 27, 2019, 17:45 GMT+00:00

US Dollar Index The Greenback had touched the culmination mark of around 98.35 top levels on May 23. However, the USD Index failed to keep hold of the

US Dollar Index

The Greenback had touched the culmination mark of around 98.35 top levels on May 23. However, the USD Index failed to keep hold of the gains and had started the plunge rally on the second half of that day. The Index had continued the downtrend until today but appeared to initiate reversal from around 97.55 low levels. Today’s primary trend in the USD Index followed the drop of German 10-year Bond Yields, which hovered near its bottom levels. Euro being the biggest rival, the Greenback benefitted out of this and was more than 0.17% up for the day. The Index marked day’s high near 97.75 levels despite lack of economic events.

All US Banks remained closed today on account of Memorial Day. At around 05:00 GMT, the Japanese March Coincidence Index, and Leading Economic Index reported slightly lesser than the estimates. Though there remained lack of any fresh US-China trade dispute headlines, speculations revealed the US plans to blacklist another Chinese firm. This time after Huwaei, the Company is Hikvision Digital Technology, Giant Surveillance Equipment Manufacturers. Trump administration displayed deeps concerns about China’s “extensive surveillance industry”. During today’s session, such underlying trade tensions kept the Greenback restrained from growing further.

GBP/USD

Cable initiated trading on Monday morning near 1.2722 levels. The day started with a clear upshoot touching day’s high near 1.2748 levels amid the release of EU Election results. Nigel Farage’s Brexit Party won the majority UK seats followed by Lib. Democratic Party. The Conservatives and Labors remained down in the list as noted in the Election outcome. Farage commented that “Never before in British politics has a new party, launched six weeks ago, topped the polls in a national election”. However, the GBP/USD pair slipped 0.60% landing near 1.2670 levels following fears of a hard Brexit. After the announcement of the results, Farage had mentioned in his speech to the press that he needs a seat at Brexit talks. He alerted that the EU-UK Divorce should happen to the earliest and within the deadline October 31, 2019. If allowed to attend Brexit talks, Farage promised to ensure a Brexit happening irrespective of an underlying deal. Meantime, with May set to leave Downing Street on June 7, candidates line up to become May’s successor.

USD/TRY

The US Dollar, Turkish Lira pair, continued declining on Monday’s session as Lira stays under the verge of an economic crash again. The USD/TRY pair traveled along a straight line around 6.0842 levels in the early morning session. Recently, the Central Bank of the Republic of Turkey (TCMB) announced the depreciating value of Turkish Lira currency.

Over the years, Turkish people have tended to use foreign currencies over the local currency, limiting usage of Lira. Hence, the Central Bank addressed banks to elevate their Reserve Requirement Ratio with the Bank. Officials believe that this would lead citizens to increase the Lira liquidity in their national territory. However, the Bank’s revenues continue plunging, depreciating the local currency. Nevertheless, a lack of new headlines over US-Sino trade talks helped the USD/TRY pair to reduce intra-day losses. The pair had touched the day’s low near 6.0300 levels and recovered later reaching near 6.0614 levels.

USD/JPY

After closing the last day’s trading session on a negative note, the pair displayed some signs of recovery. The USD/JPY pair elevated from the 109.45 levels touching near the day’s high near 109.58 levels following weak Japanese March data. Leading Economic Index came out 0.42% lower than the consensus estimates of around 96.3 points. Also, the Coincidence Index reported 99.4 points over 99.6 forecasts. The Japanese Yen lost further ground after the BoJ’s Governor Kuroda alerted of high economic instability.

About the Author

Nikhil Khandelwalauthor

Nik has extensive experience as an Analyst, Trader and Financial Consultant for Global Capital Markets. His vision is to generate Highest, Consistent and Sustained Risk-Adjusted Returns for clients over long term basis and providing them world-class investment advisory services.

Advertisement