Advertisement

Advertisement

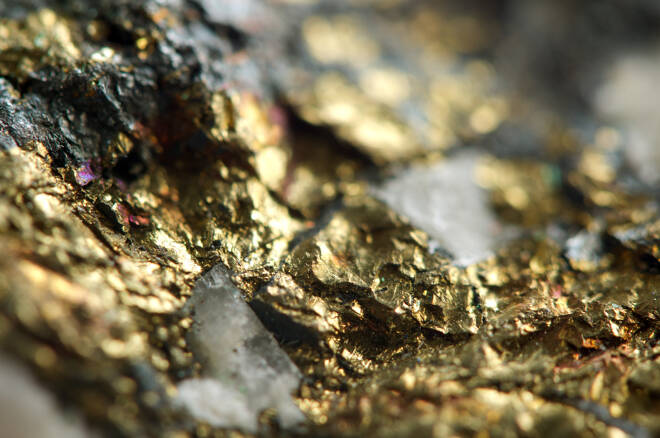

Gold Up Amid Interest Rate Cut Hopes, Palladium Tests 1,400

Published: Jun 12, 2019, 13:13 GMT+00:00

Gold is trading positive amid dollar weakness on speculations for a rate cut in the next FOMC meeting.

A pause in the global equities’ rally and speculations for a rate cut soon in the Federal Reserve are hurting the dollar and fueling precious metals such as gold and palladium.

Gold is trading positive on Monday after two negative days as investors are getting back on the metal due to concerns over the US-China trade war and speculations that a rate cut by the Federal Reserve will put the dollar down.

Palladium, on the other hand, is testing the 1,400 area after posting five days of gains.

Precious metals report for Wednesday, June 12

Gold is extending its bounce from 1,320 as the metal is posting gains on Wednesday. It is now trading as high as 1,335, recovering almost all loses suffered in the last two days.

Silver is trading positive for the second day, but the gains are limited as the metal is contained by the 200-day moving average at 14.90.

Copper is negative on Wednesday as the unit was unable to sustain gains at 2.7000. XCU/USD is extending losses to 2.6450 as it is heading to test the 2.6000 support.

Palladium is trading in consolidation mode after five days of gains versus the dollar that brought the pair from 1,320 to today’s fresh highs since April 29 at 1,405.

Platinum stopped its recovery from the 800.00 area at 820.00 as it got a rejection that sent it back to 810.00, where it is currently moving.

The rate cut is coming

Market’s experts are more and more convinced about a rate cut by the Federal Reserve in the coming months and even weeks.

Recently, Treasury Secretary Steven Mnuchin said that falling bond yields are indicating that the Federal Reserve will cut interest rate, instead of warning a recession.

“I would say that the bond markets are predicting a lowering of interest rates,” Mnuchin said. At the same time, he affirmed the Treasury does see “no signs of a recession.”

Speculations are pilling up about a rate cut in the next FOMC two-day meeting on June 18-19.

Gold jumps amid rate cut speculations

Gold is extending its bounce from 1,320 to trade near to the 1,340 area as investors are leaving the dollar behind as they do believe a Fed’s rate cut will happen as soon as June 19.

In this framework, XAU/USD is trading 0.50% positive on the day at 1,333 as the unit is taking a breath after the recent upside movement.

According to FX Empire analyst James Hyerczyk, “so far this week, the dollar has remained steady against a basket of major currencies. If it suddenly weakens, then gold prices could surge above last week’s high at $1352.70.”

To the upside, 1,345 and 1,350 are the levels to watch. Above there, 1,360 and the multi-year highs at 1,365 will be exposed.

About the Author

Mauricio Carrilloauthor

Mauricio is a financial journalist with over ten years of experience in stocks, forex, commodities, and cryptocurrencies. He has a B.A and M.A in Journalism and studies in Economics by the Autonomous University of Barcelona. While traveling around the world, Mauricio has developed several technology projects focused on finances and communications. He is the inventor of the FXStreet Currency Poll Sentiment index tool.

Advertisement