Advertisement

Advertisement

Greece Optimistic on Debt Deal Ahead of Monday Summit

Updated: Jan 1, 2011, 00:00 GMT+00:00

Greece Optimistic on Debt Deal Ahead of Monday Summit The Japanese yen held strong against the dollar yesterday as it was tossed about in competing

Greece Optimistic on Debt Deal Ahead of Monday Summit

The Japanese yen held strong against the dollar yesterday as it was tossed about in competing economic winds. The US reported positive economic news sending the dollar up for the day. The US inflation rate rose to 0.4% and jobless claims were lower than expected. As the risk of a Greek debt default grows, more investors have sought refuge in the Japanese yen and Swiss franc. Greek depositors withdrew more than $2 billion from Greek banks this week.

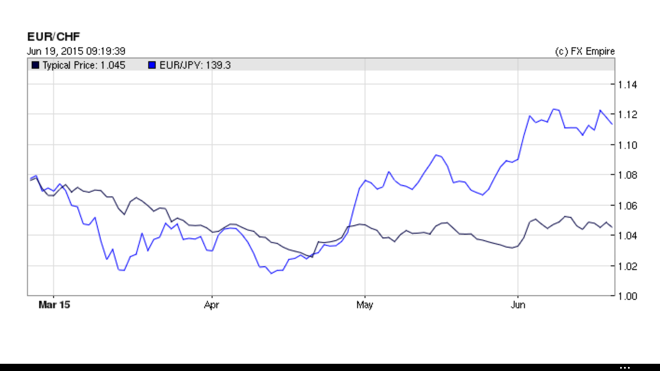

The Euro has fallen 5% against the Japanese yen and 15% against the Swiss franc in 2015. As the risk of a Greek debt default rises, the Yen has lost some strength against the Euro while the Euro has weakened against the Swiss franc as more investors seek a safe haven in the Swiss franc.

Investors Are Seeking Refuge from a Grexit in the Swiss Franc

Is it really the last act for the Greek debt crisis? The EUR/USD had lost more than 50 pips from its open of 1.1371 by mid-morning in the European trading session as the media entered the weekend with dramatic headlines of a “last chance” and “end game.” Or should you wager on Greek Prime Minister Alexis Tsipras who forewarns that “All those who are betting on crisis and terror scenarios will be proven wrong.” The negotiations will resume on Monday.

A month after falling through 1.4, the EUR/USD retook this resistance level yesterday but quickly retraced to 1.1340 when the positive US economic data was released. The US dollar carried its strength into the European lunch hour today. The US Dollar Index Spot (DXY:CUR) was up 0.31% on the day in a trading range of 93.90-94.42.

North American Preview

Canada is set to report May inflation today. Lower energy prices helped lower inflation in April to 0.8%, dipping outside of the desired inflation range for the first time since 2013. The Bank of Canada’s inflation comfort range is 1% to 3%, with a target rate of 2%. Canadian retail sales are expected to register a third consecutive month of growth.

Brazil’s mid-month June inflation rate will reveal if the country is winning the battle against rising prices. Inflation has jumped 2 percentage points in 2015 to 8.47%. Today, analysts expect to see the first contraction this year to 8.05%. Some of the inflationary pressure is coming from government-set energy prices. With energy prices stripped out, the core inflation rate is 8.41%. The government’s continued efforts to control inflation through increases in the interest rate, which is 13.75%, are starting to work. Despite the high inflation, the Brazilian real and stock market have been mostly up in 2015.

About the Author

FX Empire editorial team consists of professional analysts with a combined experience of over 45 years in the financial markets, spanning various fields including the equity, forex, commodities, futures and cryptocurrencies markets.

Advertisement