Advertisement

Advertisement

Investors rack up U.S. money market funds for a third straight week

By:

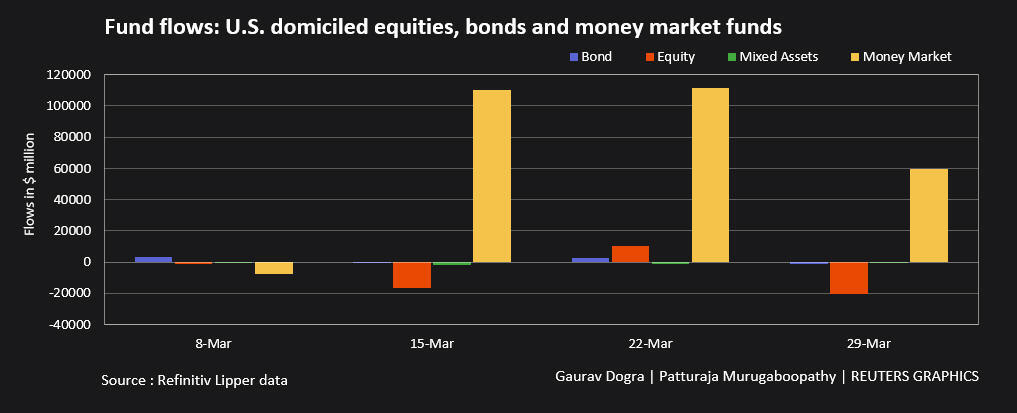

(Reuters) - Money continued to flow into safer U.S. money market funds for a third consecutive week as investors remained unsettled about the banking sector crisis, with slowdown worries also affecting the sentiment.

(Reuters) – Money continued to flow into safer U.S. money market funds for a third consecutive week as investors remained unsettled about the banking sector crisis, with slowdown worries also affecting the sentiment.

According to Refinitiv Lipper data, U.S. money market funds received a net $59.31 billion worth of inflows in the week to March 29. They have received about $273.3 billion worth of inflows so far this month.

Meanwhile, investors turned net sellers of $20.68 billion worth of U.S. equity funds after $10.17 billion worth of net purchases in the previous week.

They exited large, small and mid-cap equity funds of $8.25 billion, $2.43 billion and $1 billion, respectively.

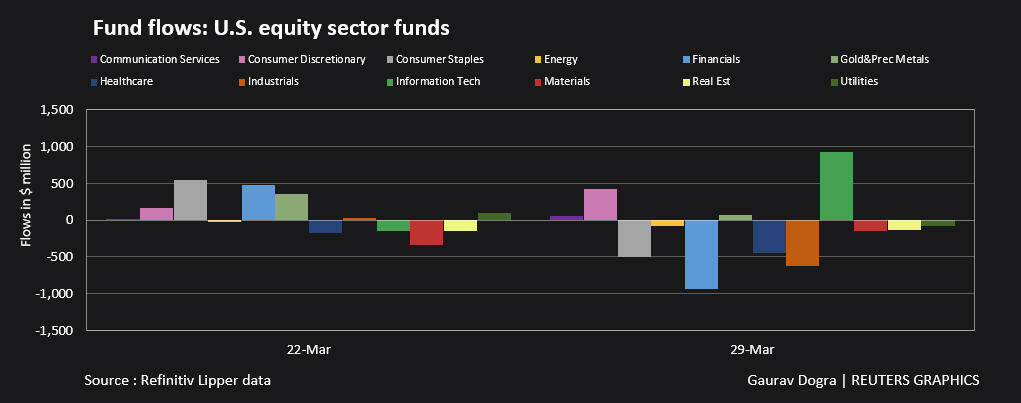

Among sector funds, financials, industrials and consumer staples saw withdrawals of $931 million, $617 million and $499 million, respectively, although tech received $926 million worth of inflows after witnessing outflows for six weeks in a row.

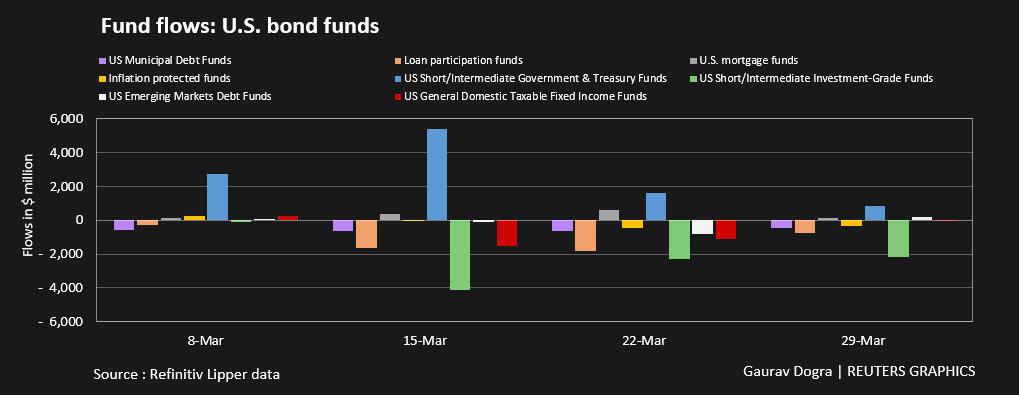

Meanwhile, investors turned net sellers of U.S. bond funds with disposals of $1.37 billion after about $2.87 billion worth net purchases in the previous week.

They sold high yield and short/intermediate investment-grade funds of $2.28 billion and $2.2 billion, respectively, but government funds drew a net $4.08 billion, marking a seventh weekly inflow in a row.

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Krishna Chandra Eluri)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement