Advertisement

Advertisement

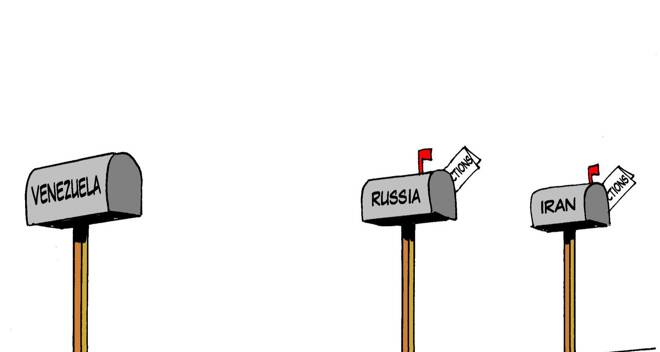

Russia, Iran & Venezuela Wildcards In Oil Prices

By:

A jump in Eurozone and UK manufacturing PMI gave speculators a reason to push up oil prices in Asia. The commodity gained 15 points to 46.29 which this

Within a few weeks Iran’s huge backlog of supplies and its increasing production will floor the global markets as the UN ratifies the agreement to end sanctions. Brent oil climbed to 48.83 adding 5 cents even though the Saudi’s refuse to cut production and will dominate the December 4th OPEC meeting. Russia remains an unknown quantity as Putin needs to see oil prices climb to fill the Russian coffers and Venezuela suffers huge economic hardships.

WTI oil prices gained by around 4.5 percent and Brent rose by 3.3 percent last week. Markets tried to discern the oil market’s direction a day after prices rallied the most in two months even as supplies kept growing. U.S. economic growth braked sharply in the third quarter as businesses cut back on restocking warehouses to work off an inventory glut, data showed.

Worries that the oversupply in oil products would swell from unseasonably warm weather and the waning maintenance cycle for U.S. refineries. Goldman Sachs warned of downside risk for oil prices through spring 2016 as U.S. and European storage utilization for distillates, which include diesel, neared historic highs Oil prices fell on Monday after soft Chinese factory data raised worries about energy demand in the No. 2 economy, while record high Russian crude output suggested little easing in the global supply glut.

U.S. crude oil stockpiles likely rose by 2.7 million barrels last week, growing for a sixth consecutive week, a Reuter’s poll showed. Industry group the American Petroleum Institute will issue its preliminary inventory data on Tuesday before official numbers on Wednesday from the U.S. government.

Early in the session, oil saw some support as the dollar came under pressure from data showing a fourth straight month of declines in October in U.S. manufacturing activity. China’s factory activity fell for an eighth straight month in October, a survey showed.

Oil prices have tumbled by more than half since June last year on a global supply glut. Worries about the glut grew on Monday, when Russia reported that its October oil production hit a post-Soviet record of 10.78 million barrels per day. The data reflected Russia’s strategy of defending its market share as rivals from the Gulf start supplying Moscow’s traditional markets.

About the Author

Barry Normanauthor

Advertisement